Editor's Note: This article was originally published in John Murphy's Market Message on Friday, May 17th at 4:49pm ET.

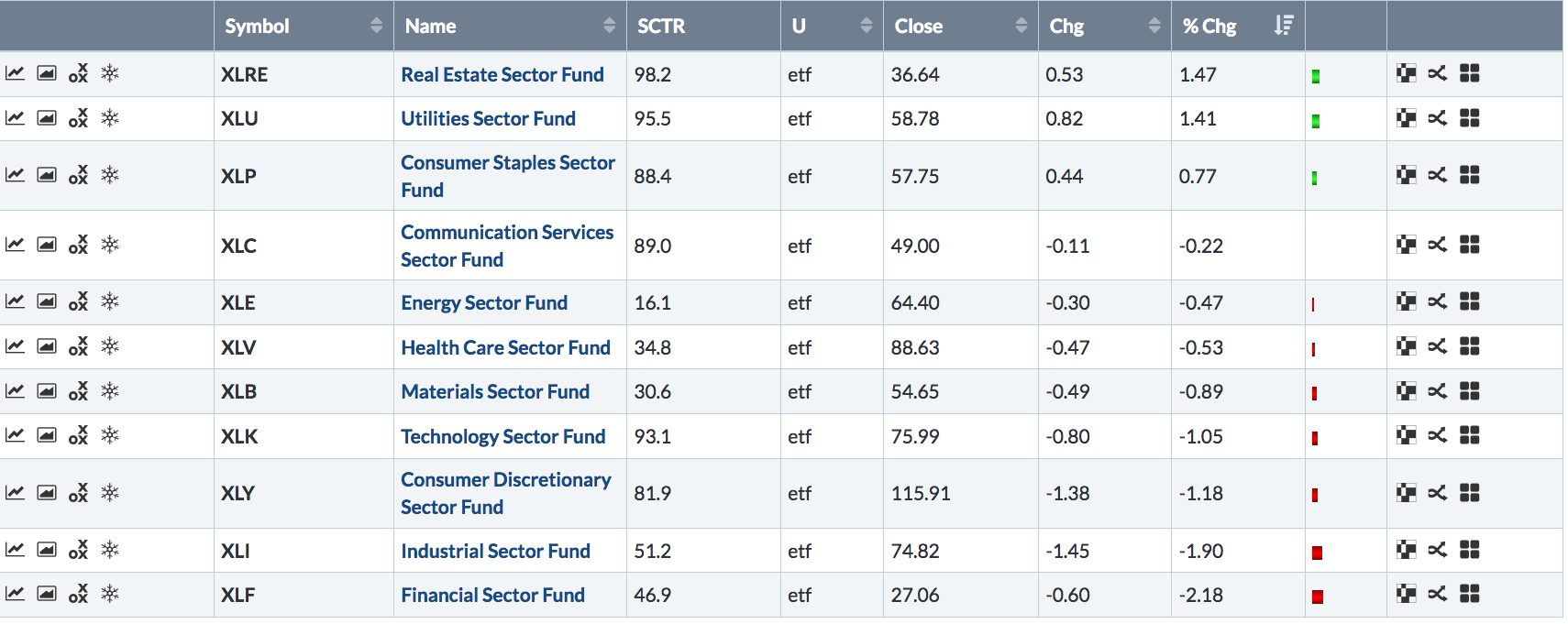

The table in Chart 1 plots the relative performance of the eleven market sectors for the week. And they show a generally defensive market. That can be seen by the fact that REITs, utilities, and consumer staples are the three top sectors for the week. At the same time, the weakest sectors are financials, industrials, cyclicals, technology, and materials. Industrials were pulled lower by Deere and Caterpillar. Technology was held back by semiconductors with exposure to China. Materials were led lower by trade-sensitive copper and steel stocks. On a brighter side, communication stocks were led higher by fixed line telecommunication stocks like AT&T and Verizon (see below). A rebound in crude oil supported energy stocks. Drug stocks gave a boost to healthcare. Consumer discretionary stocks were pulled lower by automotive stocks; homebuilders, however, were the strongest cyclical group (as they've been all year). Asset managers and banks helped make financials the week's worst sector. And therein may lie another theme for the week. And that's the impact of falling bond yields.

Chart 1