“The world is a book, and those who do not travel read only a page.” - Saint Augustine

I recently returned home after a 10-day trip to Scotland with my family for Spring Break. We rented a car in Glasgow, made our way up into the Highlands and took a ferry over the Isle of Lewis, where we rented a house for the week.

We enjoyed meeting new people and learning about Scottish Gaelic, we loved the challenge of driving a manual transmission on the left side of the road and we treasured finding cute little places to grab fresh seafood during our excursions. Most of all, we appreciated getting exposed to people and cultures and stories outside of our comfort zone.

As investors, we are often affected by so-called home bias, which suggests that, generally speaking, we tend to own stocks and companies and markets based geographically closer to our home base. To put it simply, we tend to own what’s close to home.

As investors, we are often affected by so-called home bias, which suggests that, generally speaking, we tend to own stocks and companies and markets based geographically closer to our home base. To put it simply, we tend to own what’s close to home.

Now this makes sense in some ways, as we’re much more likely to be familiar with companies we do business with, which means (especially for consumer goods) they are often located near to where we live. The problem occurs when that prevents us from looking for potentially better investment opportunities that may be located elsewhere.

Over the years, investors have tended to think more globally in their investments due to the internet, the interconnection of the global economy and the prevalence of investment vehicles such as ETFs. So, given this week’s correction in the US equity markets, where should American investors be looking for potential opportunities a little further away from home?

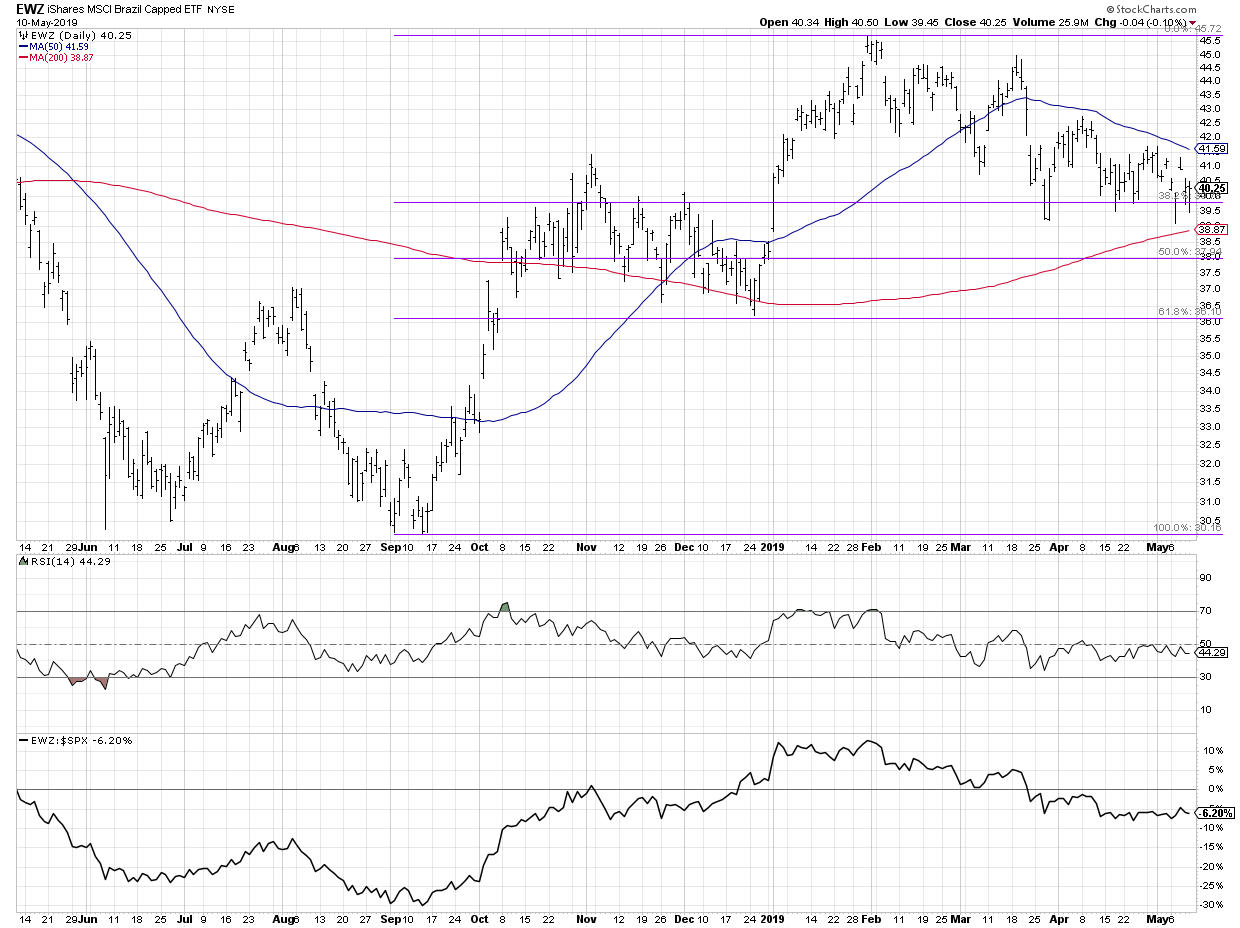

1. Brazil

There’s no surprise that the first two markets we’ll discuss have a commodity-oriented theme to them. As the US and many developed markets have thrived due to strength in technology and consumer-oriented spaces, commodity-based markets have struggled with weaker commodity prices.

There’s no surprise that the first two markets we’ll discuss have a commodity-oriented theme to them. As the US and many developed markets have thrived due to strength in technology and consumer-oriented spaces, commodity-based markets have struggled with weaker commodity prices.

However, this also means that, if and when developed markets start to struggle (a process which arguably began this week), commodity-oriented markets like Brazil may present an opportunity for an uncorrelated return profile.

After rallying from the low 30s last fall to a peak in the mid-40s earlier this year, the EWZ reached the 38.2% retracement level in late March. That level was tested again twice in the month of April, then again in the first two weeks in May. The 200-day moving average could serve as further support, currently lying just below 39.

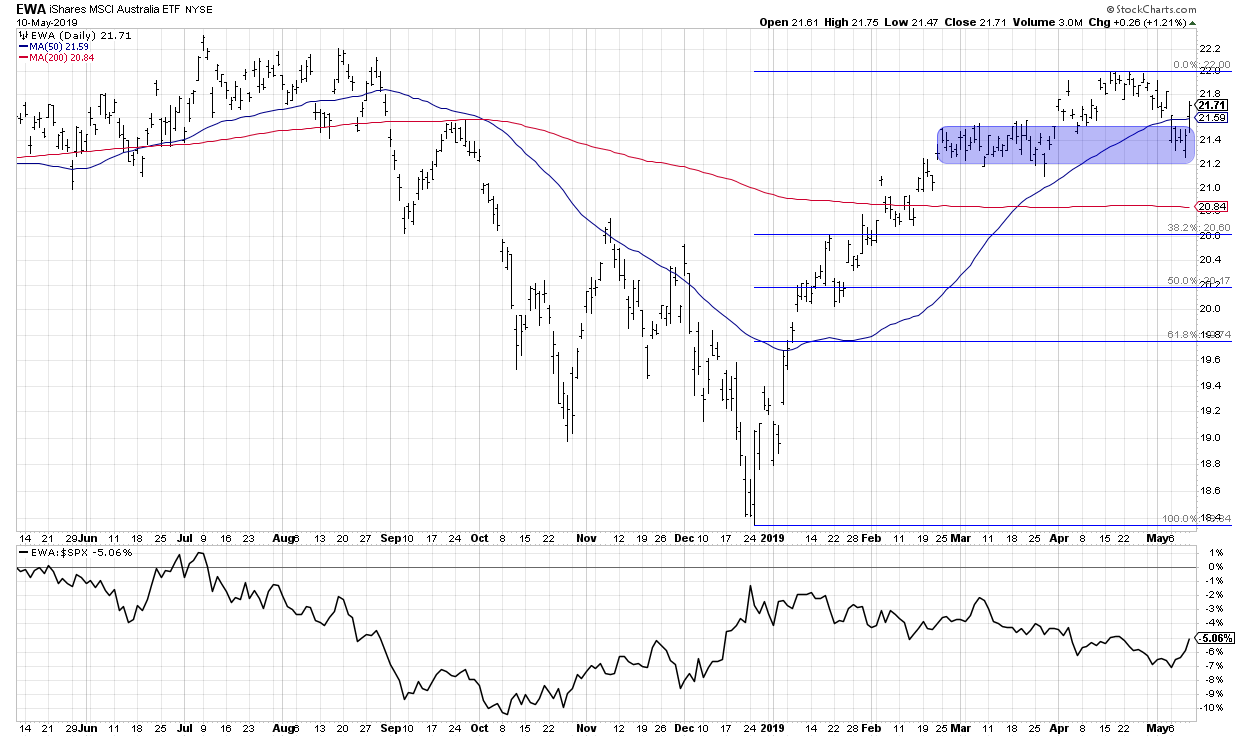

2. Australia

EWA, the Australian ETF, rallied back above its 50-day moving average this week after finding support in the 21.20-21.50 range. This is one of the few markets that closed up on the week while many other global markets suffered. This resulted in a nice uptick in relative strength going into the weekend.

EWA, the Australian ETF, rallied back above its 50-day moving average this week after finding support in the 21.20-21.50 range. This is one of the few markets that closed up on the week while many other global markets suffered. This resulted in a nice uptick in relative strength going into the weekend.

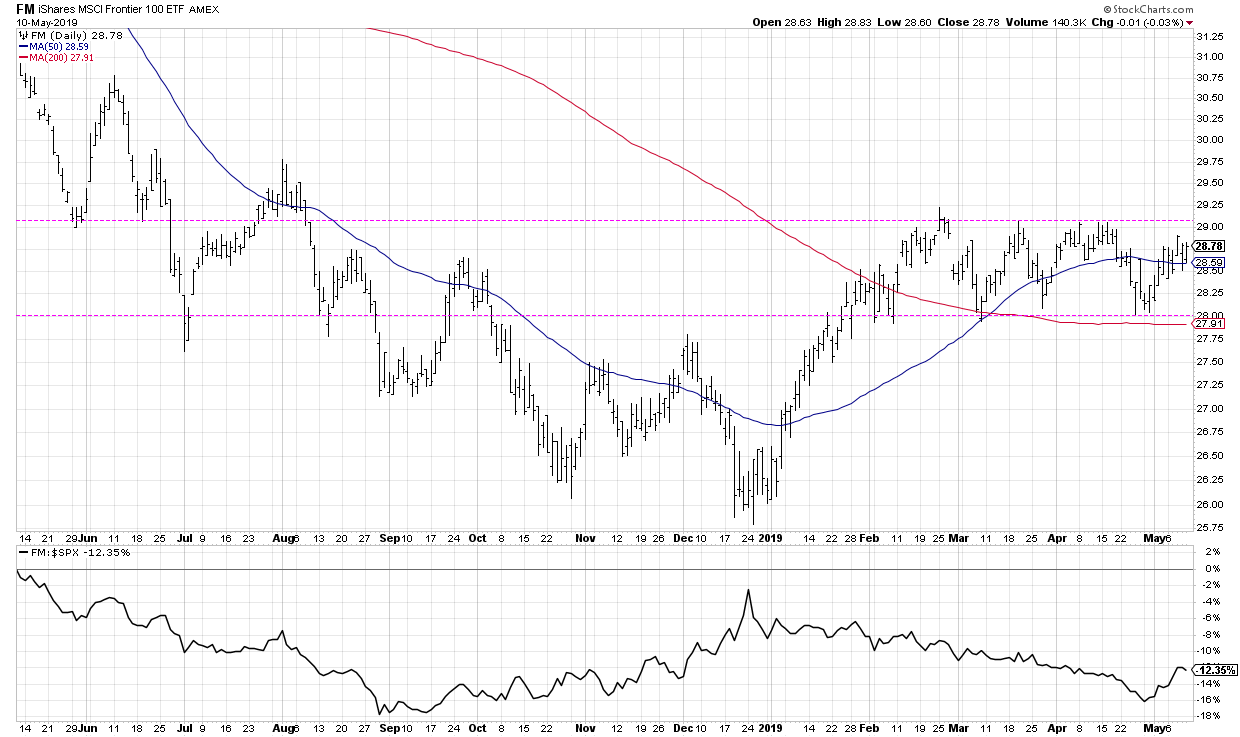

3. Frontier Markets

Frontier markets on their own don’t look incredibly rewarding here. The FM has essentially been range-bound for the last three months, often finding support at the 28 level. So we have a chart going not up, not down, but decidedly sideways.

Frontier markets on their own don’t look incredibly rewarding here. The FM has essentially been range-bound for the last three months, often finding support at the 28 level. So we have a chart going not up, not down, but decidedly sideways.

However, when you compare frontier markets to other global regions, you can see why a sideways trend isn’t all that bad.

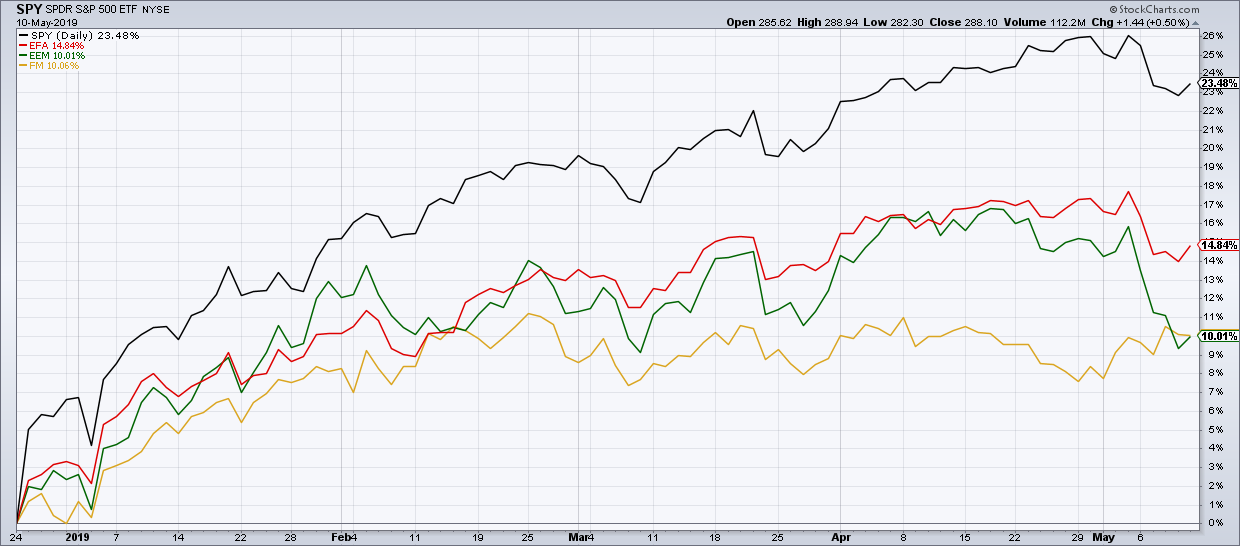

Year-to-date, the S&P 500 has far outpaced EAFE, EM and FM. But if you look at the last two weeks, you’ll see that, while all other major global ETFs have pulled back, FM has actually increased on an absolute and relative basis. In short, it’s working while other markets have not.

Year-to-date, the S&P 500 has far outpaced EAFE, EM and FM. But if you look at the last two weeks, you’ll see that, while all other major global ETFs have pulled back, FM has actually increased on an absolute and relative basis. In short, it’s working while other markets have not.

When looking for investment ideas, we often look close to home because that’s where we’re comfortable. A savvy investor knows that the best opportunities can come from many places, even ones where we have much less familiarity!

RR#6,

Dave

David Keller, CMT

President, Sierra Alpha Research LLC

www.marketmisbehavior.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.