5G is the next generation of mobile broadband and will eventually replace (or augment) your 4G LTE connection. With 5G, we should see exponentially faster download and upload speeds. All eyes are now turning toward the companies that will help launch the advent of this exciting technology. I picked out five stocks that looked interesting in this new space.

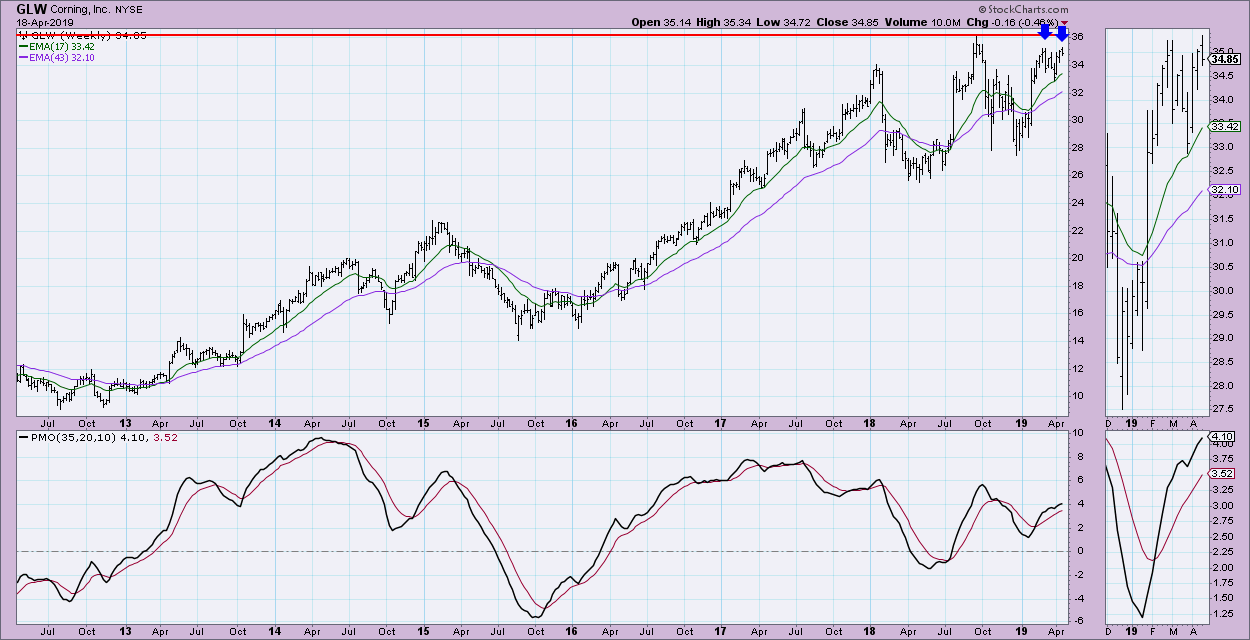

Corning Inc (GLW):

I decided to go through these five on a short-term and intermediate-term basis. GLW has been struggling with overhead resistance, but, with the new PMO BUY signal, it is likely we will see a breakout. However, with the PMO decelerating, GLW might be looking at another trip down to test $34 or $33.

The weekly PMO on all of these five stocks look pretty good and GLW is no exception. My only caveat with an intermediate-term investment is that it might be a good idea to wait and see if a double-top develops, as there could be a better entry on the horizon.

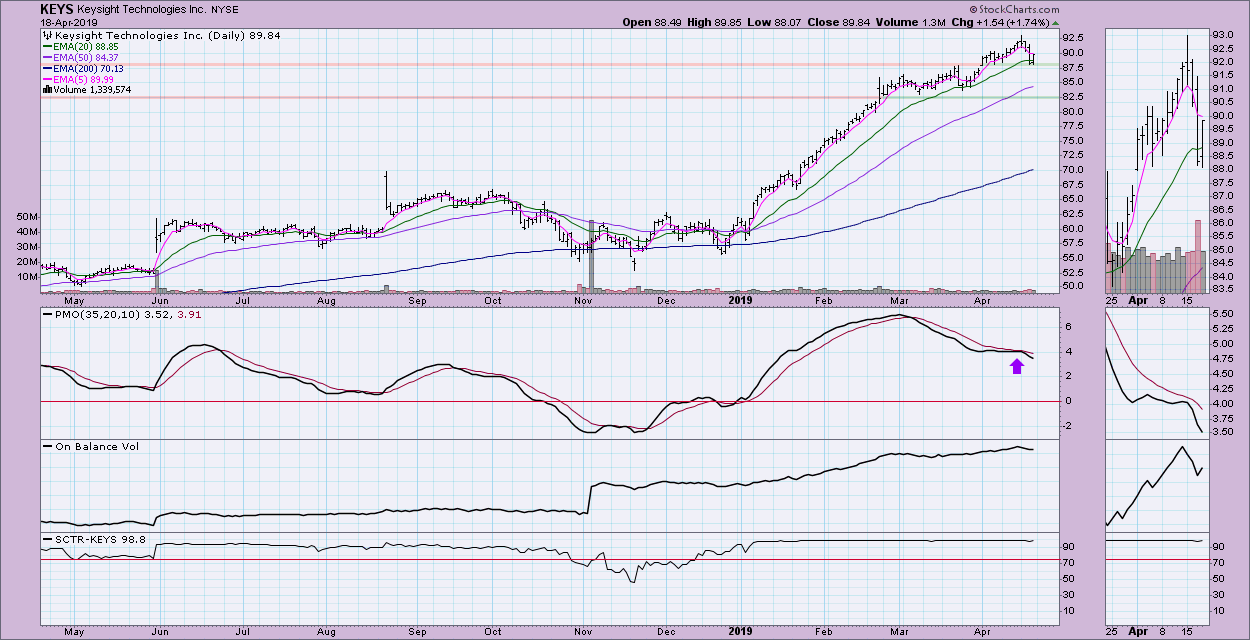

Keysight Technologies Inc (KEYS):

KEYS probably has the least desirable chart going by the PMO, which once again failed to get a BUY signal, instead kissing the signal line headed back down--a bear kiss. This suggests a breakdown. However, it is hard to argue with a near perfect SCTR ranking and healthy, rising OBV.

KEYS is making new all-time highs every time it breaks out. It doesn't have a lot of weekly data, so although the PMO is looking very overbought, a normal range has not really developed. This makes it hard to know whether it is overbought or not.

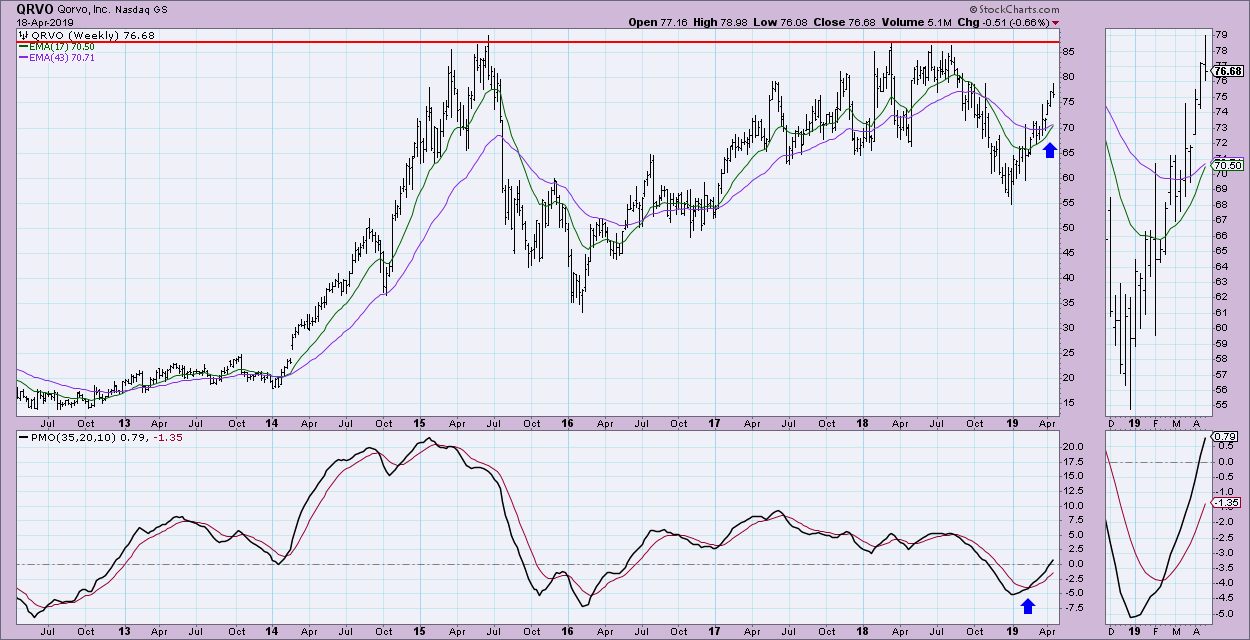

Qorvo Inc (QRVO):

I see a good looking rising trend channel--not too steep. However, for a short-term investment, I would watch out. With the PMO so overbought and turning lower, it may be time for price to test the bottom of this rising channel.

The weekly chart looks great, but, given the possibility of a short-term pullback on the daily chart, I might wait to enter even in the intermediate term. However, once that happens, I'm liking QRVO on an intermediate-term basis.

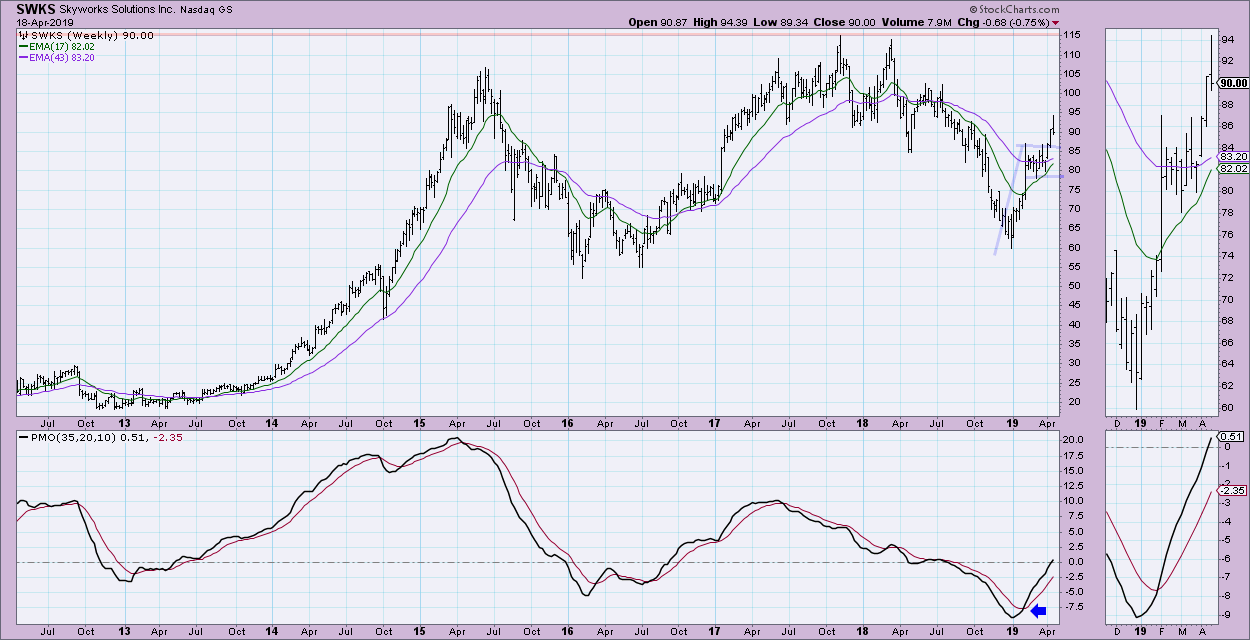

Skyworks Solutions (SWKS):

The PMO is topping. I would look for a test of support at around $86. The DecisionPoint Long-Term Trend Model executed a new BUY signal when the 50-EMA crossed above the 200-EMA, suggesting that Skyworks is moving into a bull market configuration.

I very much like this weekly chart. We got a PMO BUY signal in oversold territory, which has since been rising with very little hesitation. SWKS recently broke out from a bull flag formation; if you do the measurement on the flag pattern, the minimum upside target would be right at the all-time highs, around $115.

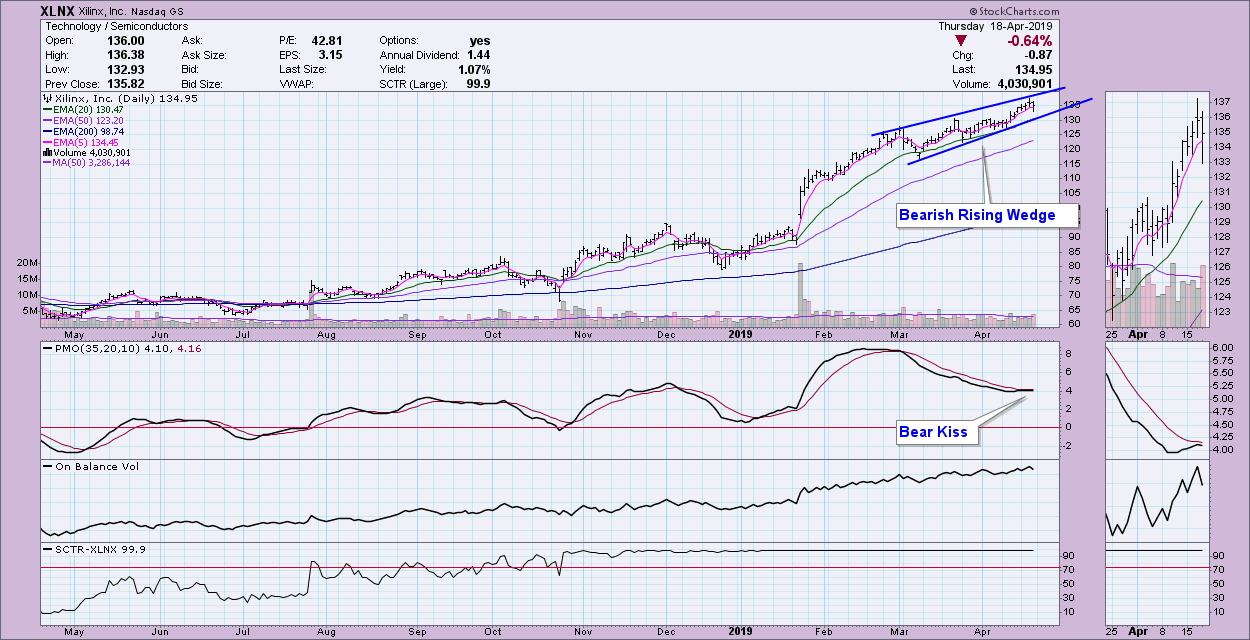

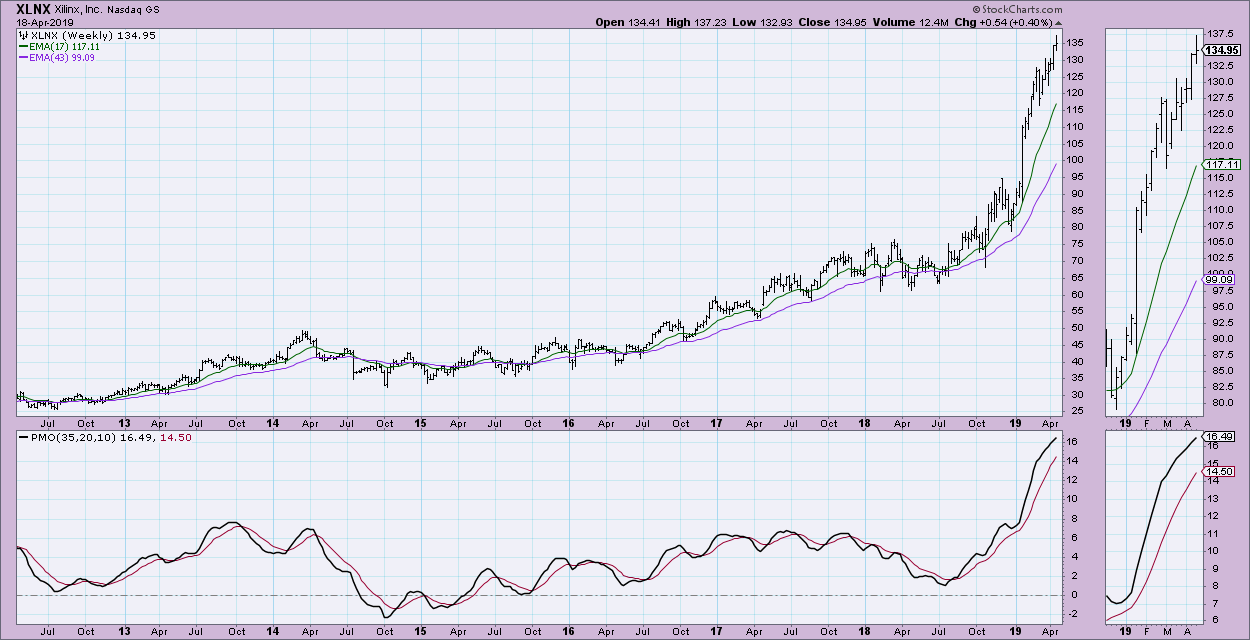

Xilinx Inc (XLNX):

I don't like the short-term bearish rising wedge. The PMO has turned down just below the signal line--another bear kiss. The good news is that the SCTR remains high and OBV is rising nicely.

Clearly XLNX is in a near-vertical move higher. These steep rising trend lines are very difficult for price to remain above. I feel like I would be chasing XLNX in the intermediate term. It needs a pullback. The weekly PMO is very overbought.

Watch the latest episode of DecisionPoint with Carl & Erin Swenlin LIVE on Fridays 4:30p EST or on the StockCharts TV YouTube channel here!

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

erinh@stockcharts.com

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**