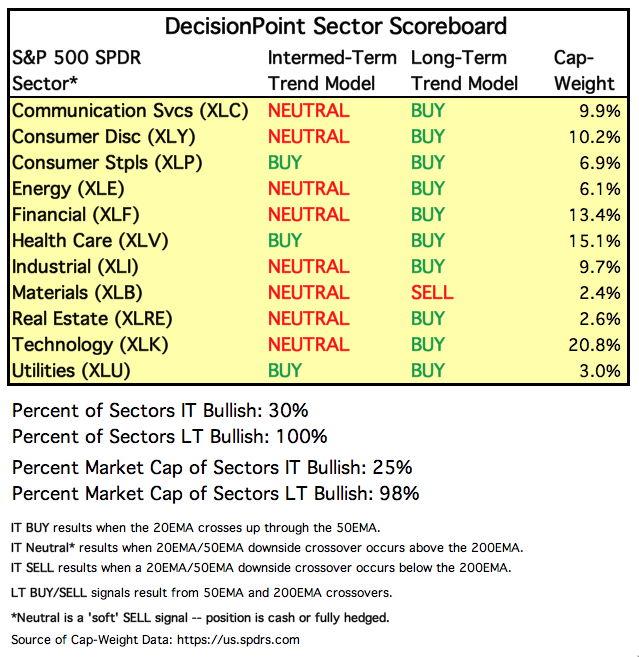

If you've explored the member dashboard, read a DP Alert or checked into the DecisionPoint Chart Gallery, you are likely familiar with our DecisionPoint Scoreboards for the SPX, OEX, INDU and NDX. What you may not have uncovered was our DecisionPoint Sector Scoreboard. Carl assembled a table that not only shows you intermediate-term and long-term buy/sell signals, but also includes the sector weightings. You'll find the DecisionPoint Sector Scoreboard in the DecisionPoint blog on Wednesdays (DP Alert) and Fridays (Weekly Wrap).

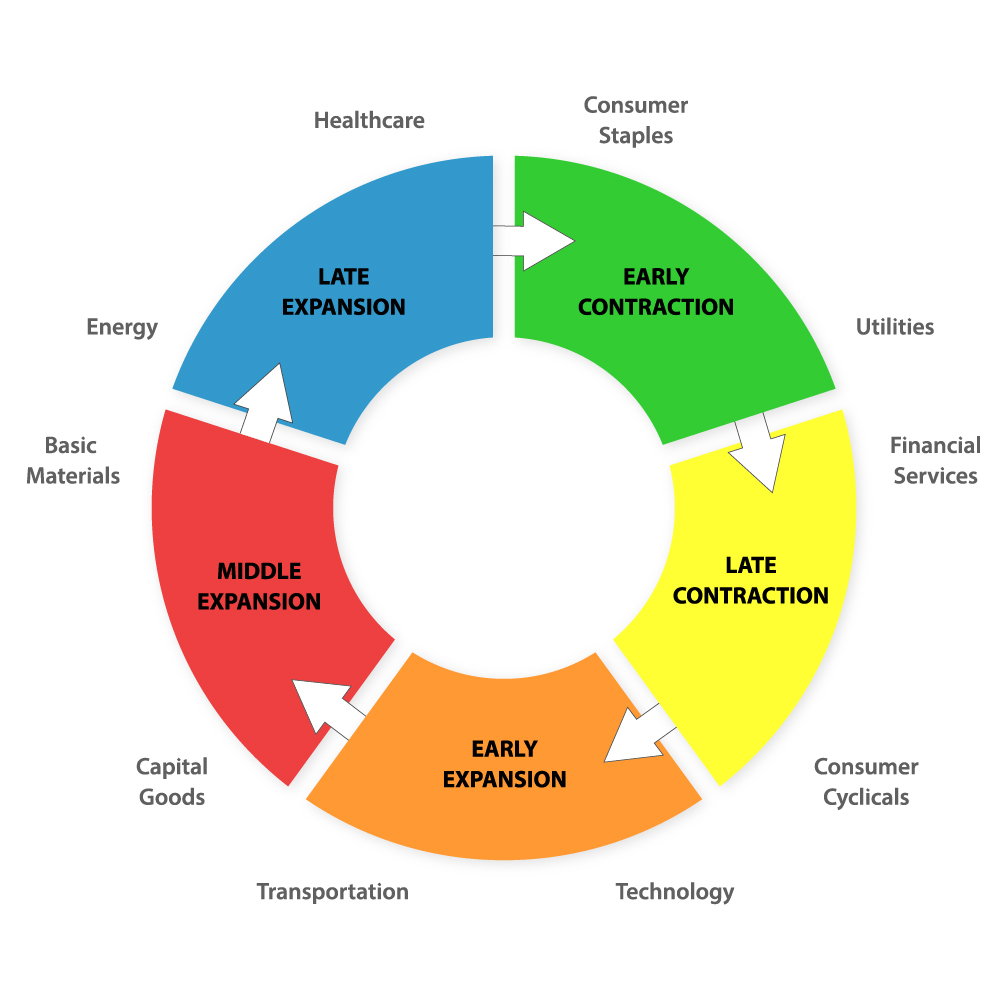

A quick glance at the DP Sector Scoreboard and the deterioration of the many of the major sectors. Since October began, this Scoreboard was completely green at the beginning of October. The remaining Intermediate-Term Trend Model BUY signals are in the "defensive" sectors. As many of our authors have written in this edition of ChartWatchers, understanding which sectors are leading, we can determine the health of the market, as well as the sentiment of participants. Below is an illustration of the rotation cycle.

The area we want to see begin to improve is Financials. Below is the daily chart of XLF. It is sitting on longer-term support right now. It has been consolidating sideways in a wide trading range starting in Mar/Apr. The IT Trend Model Neutral signal suggests we could see more of it. The PMO does make me somewhat optimistic. Yes, it is still declining, but it is very oversold. A bottom and BUY signal on the PMO might mark the beginning of a healthy rally to at least overhead resistance. I'll need to see the consolidation channel broken and at least a rising trend before I'd consider it a sign of another rotation in the market.

The area we want to see begin to improve is Financials. Below is the daily chart of XLF. It is sitting on longer-term support right now. It has been consolidating sideways in a wide trading range starting in Mar/Apr. The IT Trend Model Neutral signal suggests we could see more of it. The PMO does make me somewhat optimistic. Yes, it is still declining, but it is very oversold. A bottom and BUY signal on the PMO might mark the beginning of a healthy rally to at least overhead resistance. I'll need to see the consolidation channel broken and at least a rising trend before I'd consider it a sign of another rotation in the market.

Conclusion: With strong leadership in defensive sectors of the market, it will be hard to build an intermediate-term upside reversal. Watch for Financials to perk up next.

Conclusion: With strong leadership in defensive sectors of the market, it will be hard to build an intermediate-term upside reversal. Watch for Financials to perk up next.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**