This afternoon I ran one of my PMO scans (you'll find the link to my most popular scan in the link at the bottom of this article) and found two Travel & Tourism stocks that I found quite interesting. What I look for are Price Momentum Oscillator (PMO) readings that are rising or have had a positive crossover along with a favorable price chart. TripAdvisor (TRIP) and Booking Holdings (BKNG) both fit the bill.

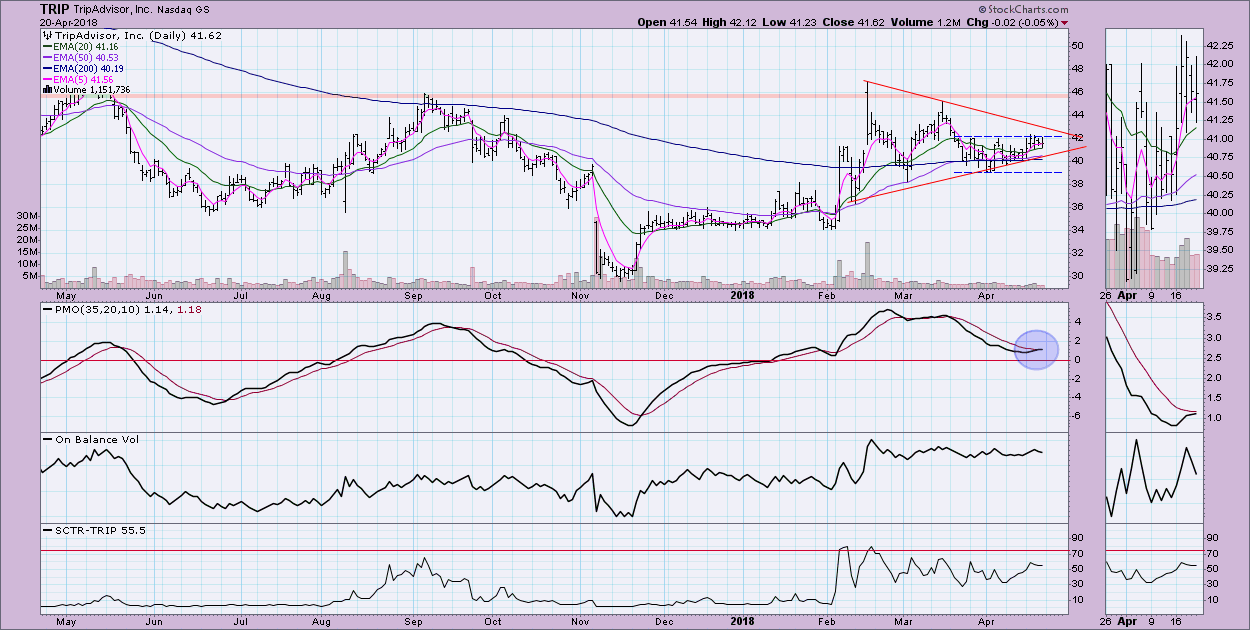

TripAdvisor (TRIP) hasn't yet broken out above resistance at $42 and declining tops line resistance is also right around there. I am looking for a breakout here. What's nice is you can set a tight stop around $40, but upside potential is at $46. A symmetrical triangle has formed. These are continuation patterns which would suggest an upside breakout from the triangle. The PMO is set for a crossover BUY signal. Note previous PMO BUY signals have accurately come in before intermediate-term price rises.

Booking is my favorite of the two. Not only do we have a classic cup and handle bullish formation, the PMO is nearing a positive crossover. Notice the healthy OBV and in the thumbnail, the clear accumulation of this stock throughout April. This pullback on the "handle" provides a great entry point with another tight stop available around 2100. Upside potential is a move to 2250 or higher.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin

Helpful DecisionPoint Links:

DecisionPoint Shared ChartList and DecisionPoint Chart Gallery

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)

**Don't miss DecisionPoint Commentary! Add your email below to be notified of new updates"**