Bull markets can advance very quickly and can become extremely overbought. It's a challenge psychologically at times to commit new money t0 a stock or ETF, knowing that just days or weeks ago prices were so much cheaper. So what the heck do you do when looking to invest cash in your account? Well, for starters, you need to realize that rotation plays a huge role in stock markets. Sectors and industry groups that once led the S&P 500 on a relative basis begin to struggle as money rotates and moves to other areas, which then begin to lead. Want an example?

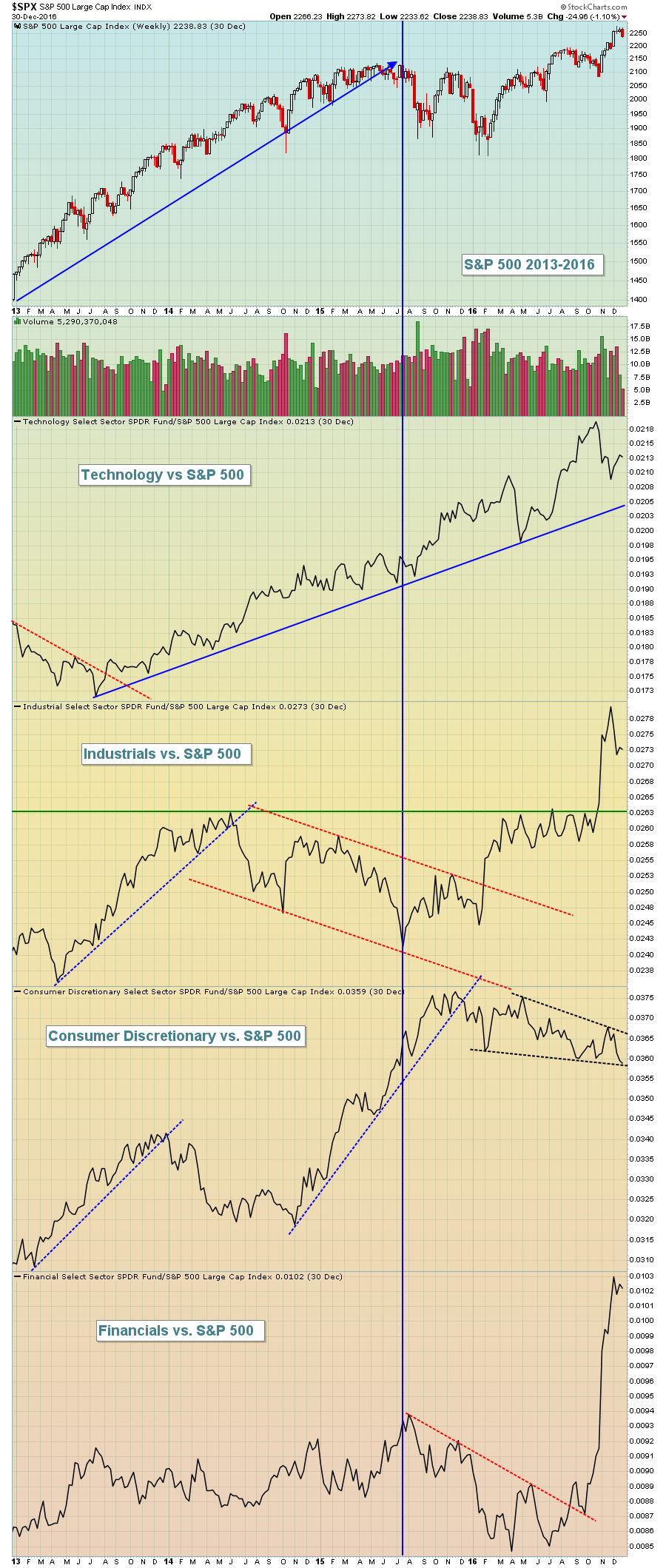

The S&P 500 moved nearly straight up from 2013 through mid-2015, but technology (XLK) was really the only sector that outperformed the benchmark S&P 500 throughout that period. Even the XLK was weak on a relative basis in early-2013. If you look at the other aggressive sectors, however, you'll see there were pockets of relative strength followed by relative weakness, then back to relative strength. This "rotation" is critical to bull markets. As money leaves one area of the market, it doesn't completely leave stocks. It simply moves to a different area and this is a hallmark of bull markets.

The S&P 500 moved nearly straight up from 2013 through mid-2015, but technology (XLK) was really the only sector that outperformed the benchmark S&P 500 throughout that period. Even the XLK was weak on a relative basis in early-2013. If you look at the other aggressive sectors, however, you'll see there were pockets of relative strength followed by relative weakness, then back to relative strength. This "rotation" is critical to bull markets. As money leaves one area of the market, it doesn't completely leave stocks. It simply moves to a different area and this is a hallmark of bull markets.

I've provided examples recently of my trading strategies in an overbought market. In my Friday Trading Places blog article, for example, I discussed the recent pullbacks in gambling ($DJUSCA), renewable energy ($DWCREE) and brewers ($DJUSDB) as opportunities.

Also, a little more than a week ago on MarketWatchers LIVE, I did a 2018 Stock Market Forecast that lasted roughly 35-40 minutes, identifying areas that we might look for rotation and leadership in 2018.

Happy trading!

Tom