ENERGY ETF REACHES FIVE-MONTH HIGH ... It was reported Thursday that the headline CPI for August rose 0.4% from the previous month, which was its biggest monthly gain since January. That boosted its year-over-year comparison to 1.9%, which is just shy of the Fed's target of 2% inflation. The biggest reason for that jump was a 2.8% monthly gain in the price of gasoline. The core CPI figure (excluding food and energy) rose 0.2% during August, which was its biggest monthly gain since February (for a year-over-year gain of 1.7%). Rising housing costs were the biggest reason for that gain. Futures markets raised expectations for a Fed rate hike in December from 30% to just over 50%. That also boosted bond yields here and elsewhere (more on that shortly). As you know, low inflation has been viewed as the main factor holding the Fed back from another rate hike this year. Which is why yesterday's strong report is encouraging to those looking for higher rates. And that brings me back to one of my favorite themes regarding inflation and the Fed. I find it ironic that energy prices are the main force driving the CPI higher, while the Fed continues to exclude energy from its inflation readings. Hurricane Harvey probably had more to do with the higher August CPI than anything the Fed has done. Chart 1 shows the Power Shares Energy Fund (DBE) climbing to the highest level in five months. [The DBE includes crude oil, gasoline, heating oil, and natural gas]. It has climbed above a falling resistance line extending back to January, and its 200-day moving average. Weather is playing a role in its recent advance. But the chart argues for higher energy prices. That's helping boost energy shares. And may argue for higher inflation readings. A falling dollar is also helping. So is this week's sharp jump in the British Pound.

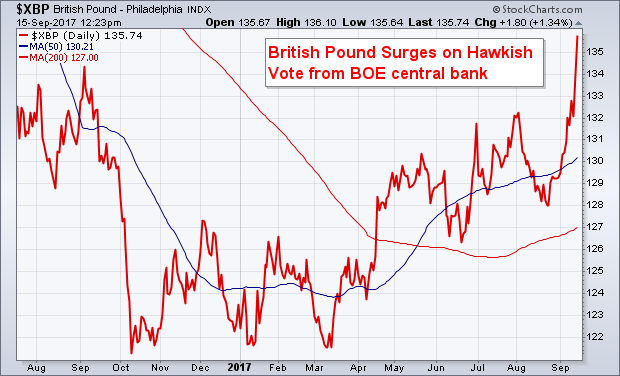

BRITISH POUND SURGES TO YEARLY HIGH ... Inflation in the UK has jumped to 2.9%. The Bank of England left UK rates unchanged on Thursday, but voted in favor of tighter monetary policy in the near future (which suggests a rate hike this year). That gave a big boost to the British Pound. Chart 2 shows sterling surging nearly 3% this week to the highest level in a year. Sterling has gained 10% against the dollar this year (versus a 13% gain for the euro). The pound is the third biggest foreign currency in the Dollar Index basket with a weight of 12% (behind the euro and the yen). It's rise this week is keeping downward pressure on the dollar which is supportive to commodity prices. The pound is also being supported by higher UK bond yields.

BRITISH POUND SURGES TO YEARLY HIGH ... Inflation in the UK has jumped to 2.9%. The Bank of England left UK rates unchanged on Thursday, but voted in favor of tighter monetary policy in the near future (which suggests a rate hike this year). That gave a big boost to the British Pound. Chart 2 shows sterling surging nearly 3% this week to the highest level in a year. Sterling has gained 10% against the dollar this year (versus a 13% gain for the euro). The pound is the third biggest foreign currency in the Dollar Index basket with a weight of 12% (behind the euro and the yen). It's rise this week is keeping downward pressure on the dollar which is supportive to commodity prices. The pound is also being supported by higher UK bond yields.