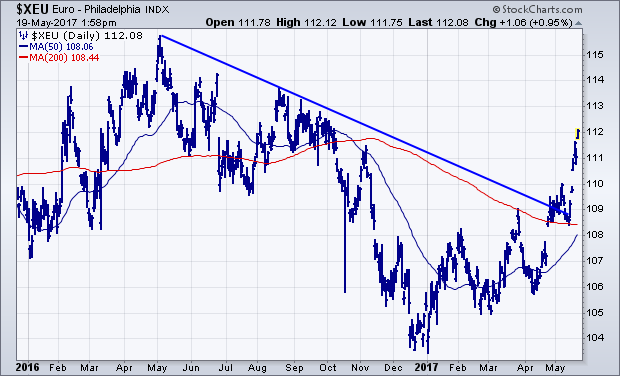

While stocks were rebounding last week, the dollar wasn't. Chart 1 shows the Power Shares Dollar Index ETF (UUP) falling again Friday to the lowest level since November. It may seem surprising to see the dollar continuing to drop with bond yields bouncing along with stocks. The dollar drop, however, may have more to do with improving European currencies. Chart 2 shows the Euro surging to the highest level since last October. Improving economic conditions in the eurozone (as reflected in strong stock prices), as well as an uptick in inflation, are supporting that currency. The Euro has the biggest weight in the Dollar Index (57%). As a result, its rise is the biggest reason the UUP is falling. Chart 3 shows the British Pound climbing to an eight month high as well. That's a sign of more optimism in the UK economy. All of which suggests that the drop in the dollar may have less to do with deteriorating conditions in the US, and more to do with an improving situation in Europe. That also explains why global funds have been rotating into Europe. American investors are getting dual benefits from rising European stocks as well as currencies. That's giving a added boost to European stock ETFs that are quoted in weaker dollars. The falling dollar, however, is finally giving a lift to commodities.