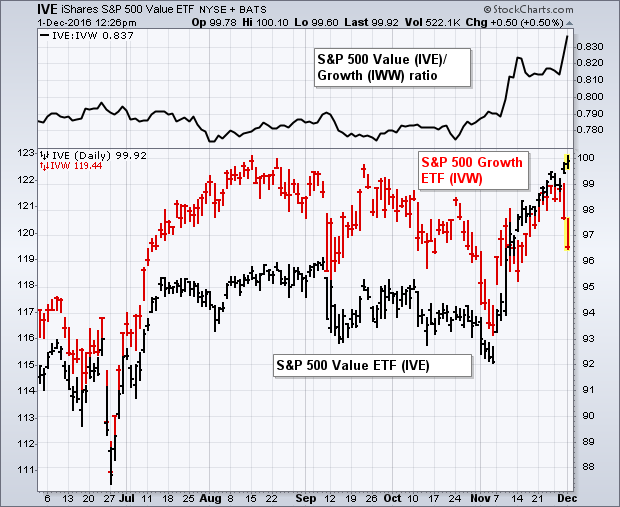

Two days after the election (November 10), I wrote a message entitled: "Rotation Out of Growth Stocks into Value Stocks Causes Profit-taking in Technology". We're seeing a replay of that rotation again this week as technology stocks are underperforming the market while financials, energy, and industrials surge. Chart 1 compares the move to new highs in the S&P 500 Value ETF (black bars) to the weaker action in the S&P 500 Growth ETF (red bars) since the start of November. That rotation can be seen more graphically by the surge in the IVE/IVW ratio over the last month (top of chart). The reason behind the rotation is understandable. Technology accounts for 35% of the growth ETF (IVW). Meanwhile, the three largest value groups are financials (25%), energy (12%), and industrials (11%). A lot of money has moved into those last three groups which were perceived as relatively undervalued. Money used to make those purchases has been coming out of more expensive technology stocks. And that rotation into cheaper parts of the market may have a lot further to run.

A lot of questions are being asked about whether or not recent rotations into cheaper parts of the market can continue. The next chart suggests that they can. The red line on top is a relative strength ratio of the Technology SPDR (XLK) divided by the S&P 500. It's clear that technology has been a market leader for the last ten years. The Financials (XLF)/SPX ratio (green line), however, shows that sector to have been a terrible performer since 2007. It's only just starting to rise. The gray area shows the energy sector (XLE/SPX ratio) to have been a very weak performer as well. Chart 2 suggests that both of those previously ignored groups have a long way to go to restore them to their normal market relationship. [Transportation stocks, which are helping drive the industrial sector higher, could be added to the list of undervalued stocks starting to play catch up, as well as industrial metal stocks like copper and steel that have been pulling material stocks higher]. The economy appears to be evolving from a deflationary, low interest world into a more inflationary period with rising rates and stronger economic growth. Monetary stimulus is giving way to fiscal stimulus which should lead to more infrastructure spending. That suggests that post-election rotations may have a lot further to go. All the more reason to be in those market sectors that will benefit the most from that new economic climate. Technology may not be one of them.

A lot of questions are being asked about whether or not recent rotations into cheaper parts of the market can continue. The next chart suggests that they can. The red line on top is a relative strength ratio of the Technology SPDR (XLK) divided by the S&P 500. It's clear that technology has been a market leader for the last ten years. The Financials (XLF)/SPX ratio (green line), however, shows that sector to have been a terrible performer since 2007. It's only just starting to rise. The gray area shows the energy sector (XLE/SPX ratio) to have been a very weak performer as well. Chart 2 suggests that both of those previously ignored groups have a long way to go to restore them to their normal market relationship. [Transportation stocks, which are helping drive the industrial sector higher, could be added to the list of undervalued stocks starting to play catch up, as well as industrial metal stocks like copper and steel that have been pulling material stocks higher]. The economy appears to be evolving from a deflationary, low interest world into a more inflationary period with rising rates and stronger economic growth. Monetary stimulus is giving way to fiscal stimulus which should lead to more infrastructure spending. That suggests that post-election rotations may have a lot further to go. All the more reason to be in those market sectors that will benefit the most from that new economic climate. Technology may not be one of them.