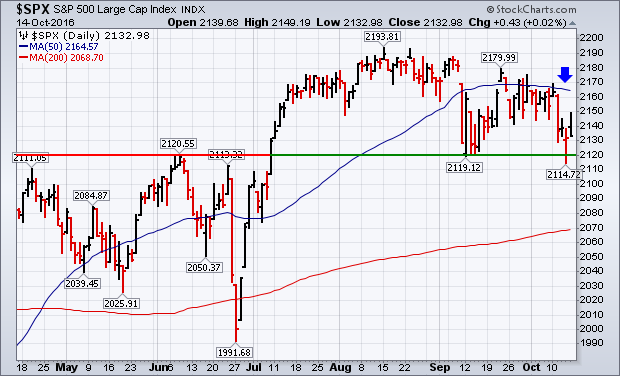

A morning bounce in stocks faded by the end of the day. Chart 1 shows the S&P 500 ending the day at its low. That keeps stocks in a short-term downside correction and well below a falling 50-day average (blue arrow). It also leaves open the possibility that the September low could still be retested. Rising bond yields continue to weigh on stocks. Chart 2 shows the 10-Year Treasury Yield ending the week on a strong note after bouncing off its 200-day moving average. That pushed bond prices lower again. The jump in yields pushed utilities lower while supporting financials. Rising Treasury yields continue to push the dollar higher. Chart 3 shows the U.S. Dollar Index (UUP) ending the week at a seven-month closing high. That's also weighing on large cap stocks.