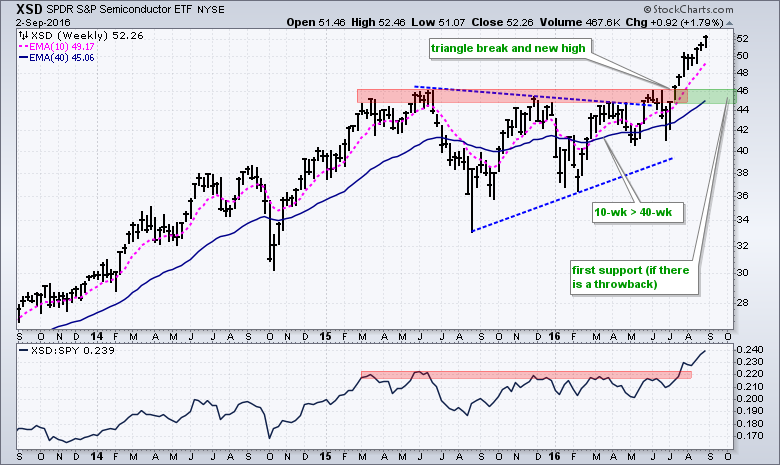

Semiconductors are leading the charge in tech stocks as the Semiconductor SPDR (XSD) extends its gains and notches another 52-week high this week. Note that the ETF is up around 15% the last three months and it is one of the top performing industry group ETFs. The Semiconductor iShares (SOXX) is also trading at a 52-week high. On the price chart, XSD broke out and the breakout zone in the 45-46 area turns first support to watch on a throw back. A throw back occurs when prices breakout and then return to broken resistance, which then becomes support. The indicator window confirms upside leadership as the price relative broke (XSD:SPY ratio) above its 2015 highs. Overall, it is positive to see this cyclical group leading the stock market.

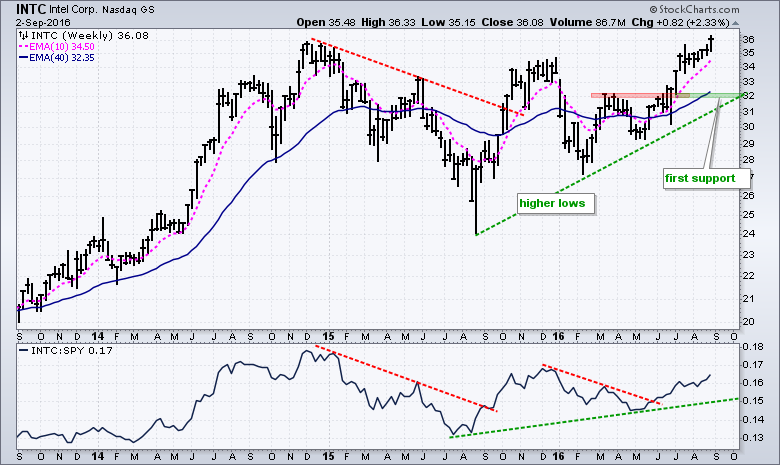

Intel surged over 2% this week and exceeded its 2014 high. The stock already hit a 52-week high in June and this week's high is a multi-year high. Any stock trading at a multi-year high should be considered a chart leader. In a separate, but perhaps related observation, note that Microsoft hit a 52-week high last week. This makes me wonder where DELL would be if it were still trading. Note that the newly formed Hewlett Packard Enterprise (HPE) is trading a new high.

****************************************

****************************************

Thanks for tuning in and have a good weekend!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************