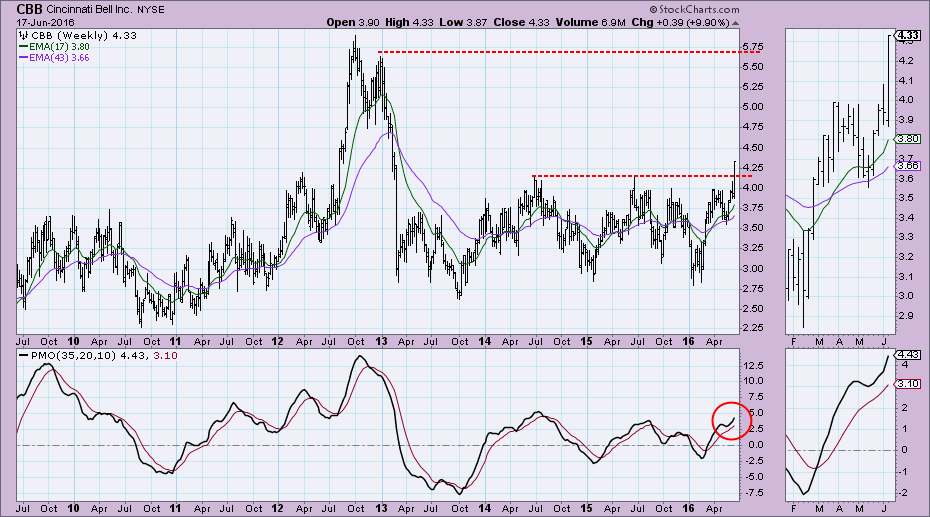

I wrote an article on Cincinnati Bell (CBB) at the end of May. I stated back then that a move to $4.00 was likely. The Price Momentum Oscillator (PMO) had bottomed but had yet to deliver a BUY signal. Since then CBB has gone through a few changes. The most important being a decisive (> 3%) breakout ABOVE $4.00.

Granted Friday's crazy rally helped CBB with the decisive breakout. Apparently Barron's had indicated it was a good BUY. Looking at this daily chart, I would have to agree with the bullishness that Barron's has bestowed on CBB. The PMO triggered a BUY signal in neutral territory. The SCTR and OBV lines are extremely bullish right now.

The weekly chart shows that a new trading range may be in the process of developing, with $4.15 acting as the base of that range. The weekly PMO is rising and is not in danger of getting overbought for some time. Notice that CBB has not seen $4.25 since it crashed in 2013. For safety, I would make sure that $4.00 is going to hold up as support.

Come check out the DecisionPoint Report with Erin Heim on Wednesdays and Fridays at 7:00p EST, a fast-paced 30-minute review of the current markets mid-week and week-end. The archives and registration links are on the Homepage under “What’s New”.

Technical Analysis is a windsock, not a crystal ball.

Happy Charting!

- Erin