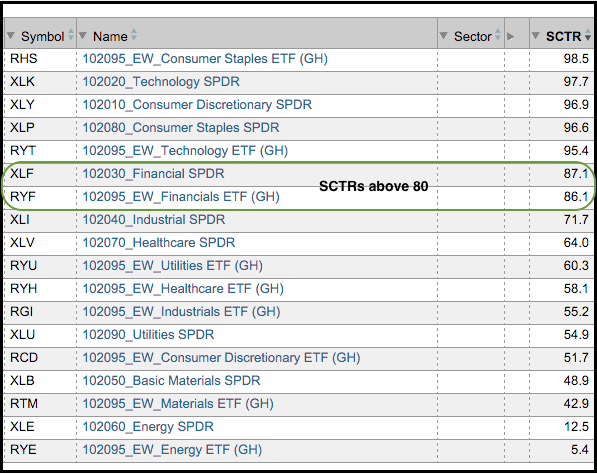

The finance sector is one of the stronger sectors right now and this is positive for the overall market. As the table below shows, the Finance SPDR (XLF) has the fourth highest StockCharts Technical Rank (SCTR) of the nine sector SPDRs and the EW Finance ETF (RYF) has the third highest SCTR of the nine equal-weight sectors. Also note that the SCTRs for both are above 85 and this means both are in the eighty-fifth percentile for performance (top 15% of our ETF universe). The finance sector is important because it accounts for around 16.5% of the S&P 500, 18% of the equal-weight S&P 500 and a whopping 25.5% of the Russell 2000. I will look at the charts for XLF and RYF after the jump. Note that the EW Finance ETF (RYF) and Regional Bank SPDR (KRE) were featured in Tuesday's webinar - click here to view - no subscription required!

On the price chart, the EW Finance ETF (RYF) broke out in October and surged over 10% from low to high. The ETF was overbought after this surge and needed some time to digest these gains (consolidate). An ascending triangle is taking shape now and a break above the recent highs would signal a continuation higher. Such a move would bode well for finance-related industry groups like big banks, regional banks, brokers and insurers.

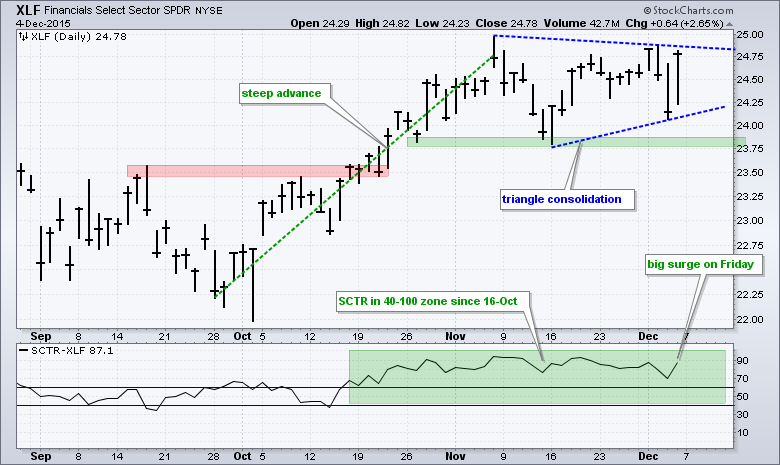

The indicator window shows the SCTR with lines at 40 and 60. A move above 60 shows relative strength and this remains the case until a move below 40. Using these levels, I basically divide the SCTR values into two groups: the 0 to 60 range means the relative performance cup is half empty and the 40 to 100 range means the relative performance cup is half full. The SCTR for RYF moved above 60 in late September, held this level in mid October and has been above 65 since October 22nd. The second chart shows the Finance SPDR (XLF) with a breakout, surge and triangle, which is a bullish continuation pattern. A break above the early December high would signal a continuation higher. Note that the EW Finance ETF (RYF) and Regional Bank SPDR (KRE) were featured in Tuesday's webinar - click here to view - no subscription required!

****************************************

Thanks for tuning in and have a good weekend!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************