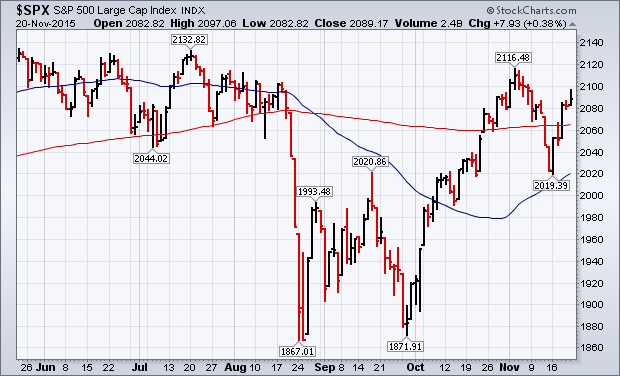

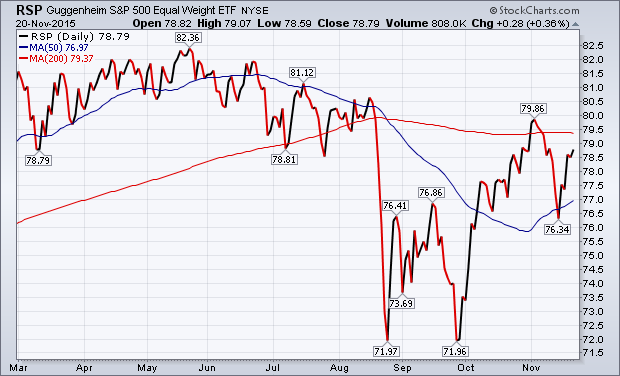

S&P 500 REGAINS ITS 200-DAY AVERAGE -- EQUAL WEIGHTED VERSION LAGS... This time last week, the S&P 500 Index had fallen back below its 200-day average and was testing chart support at its September peak at 2020 (and its 50-day moving average). It survived that test and regained its 200-day line this week. In so doing, its 3.27% gain was the biggest of the year. Large caps, however, which dominate the cap-weighted SPX, are still leading the market higher. The bottom chart shows the Guggenheim S&P Equal Weight ETF (RSP) still trading below its 200-day line. Since all stocks in the RSP are equally weighted, it gives less weight to larger stocks. A move back above its 200-day line would be a positive sign for it and the rest of the market.

Happy Thanksgiving!

- John