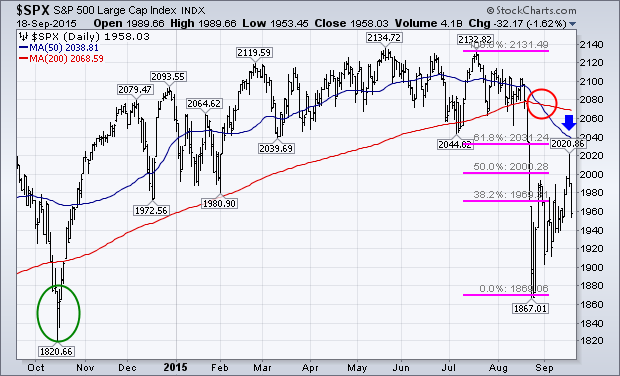

My September 2 message addressed the question about whether the market is in a normal correction or something more serious. We'll find out soon enough. I've leaned toward the correction view (a drop of 10-15%), but a lot of longer-term indicators suggest a more serious decline (20% or more). The only way we'll know for sure is whether or not previous support levels hold. The daily bars in Chart 1 put the recent stock rebound in better perspective. Thursday's downside reversal day in the S&P 500 took place just shy of the 62% retracement line. (The Dow bounce ended closer to the 50% line). Those are normal spots for a counter-trend bounce to end. The SPX also fell short of its 50-day average. The 50-day also remains below the 200-day line which is a negative sign. The normal expectation is for a retest of the August low which means a loss of -12% from its May high. A drop to more important support at last October's low near 1820 would constitute a loss of -15% from its May high which is still correction territory. But that low has to hold if this is just a correction. The month of October is also very important. My August 26 message studied three previous downturns in 1987, 1998, and 2011. All required a retest of the first low before turning back up again. And all three bottoms took place during October. All we can say with some degree of confidence at this point is that prices are probably headed lower in the weeks ahead, most likely into October. How much lower will depend on whether or not previous lows hold. In the meantime, a very cautious stance is still warranted.

The weekly bars in Chart 2 are an updated version of a chart shown in my September 2 message. The steeper trendline starting in 2011 has been broken. That suggests the four-year rally has ended. The current correction could retest last October's low at 1820 (flat line). We may be on track for that to happen. The lower trendline drawn under the 2009/2011 lows, however, is still intact. A retest of that support line near 1700 would represent an SPX loss of -20%. That would qualify as a bear market, but with the longer-term upturn intact. It would also leave prices above the 2007 peak near 1576. It's also encouraging that the 14-week RSI line (top of chart) is nearing oversold territory near 30 for the first time in four years. Speaking of bear markets, it's important to distinguish between different types of bears. In a "secular" bear market (between 2000 and 2009), bear markets can lose as much as 50% (and they did). In a secular uptrend (which I believe we're in), a "cyclical" bear market is much shallower. So even if this does turn into a bear (-20 to -25%), I think it would be a "cyclical" versus a "secular" bear.