A solid labor market had bond traders heading for the exits on Friday and that extended the recent surge in treasury yields. The 10 year treasury yield ($TNX) closed at its highest level since early October and that has many traders heading for the financial sector. While the financial ETF (XLF) has been flat over the past six months, badly lagging consumer discretionary (XLY), healthcare (XLV) and technology (XLK), the relative performance of the XLF has turned considerably higher since early February. During these past 3+ months, the TNX has risen from 1.65% to 2.40%. One industry group that LOVES the higher rates and the steepening yield curve is banks ($DJUSBK), which has surged higher by 16-17% since February 1. While some financial industry groups have already confirmed breakouts, others are on the verge and will be worth watching.

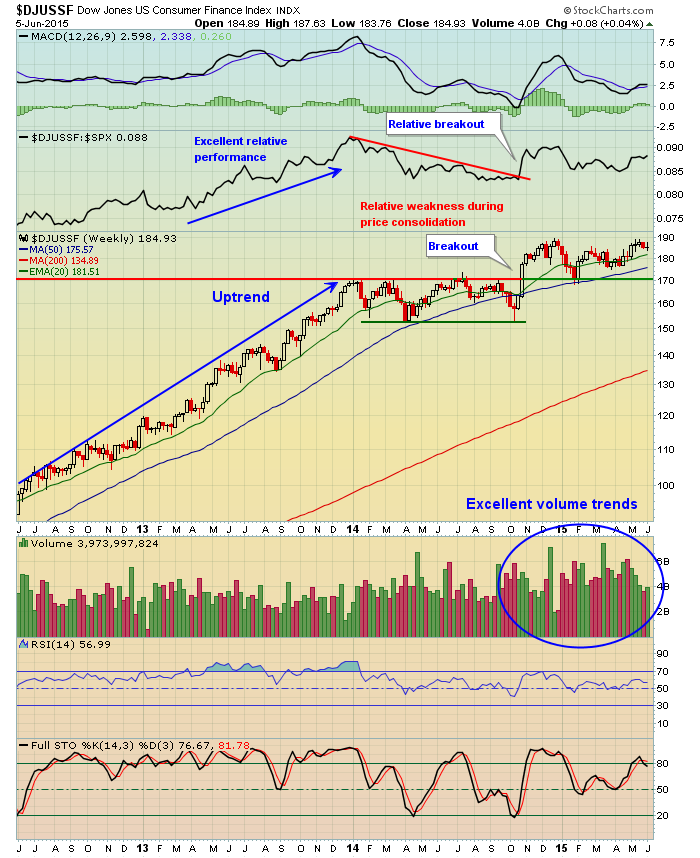

Today I'll focus on consumer finance ($DJUSSF). Check this out:

Consumer finance stocks consolidated in 2014 after a strong push higher in 2013. Since that consolidation, however, the DJUSSF has been rising in both absolute and relative terms. This bullish behavior is likely to continue so finding solid stocks within this space should benefit your portfolio in the second half of 2015.

Happy trading!

Tom