Chart 1 shows Wal Mart surging 4% today to break out to a record high. That's a pleasant change for the world's largest retailer which has hardly been a market leaders. The WMT/SPX relative strength ratio (above chart) is just starting to rise after falling for most of the last year. That's obviously a positive sign for the retail sector as well. Falling oil prices are one of the catalysts behind the recent surge in retailers. But there may be more to it than that. Lower end retailers appear to be getting most of the boost from falling energy costs. In addition to Walmart, that would include stocks like Costco, TJX, and Target. Let's take a look.

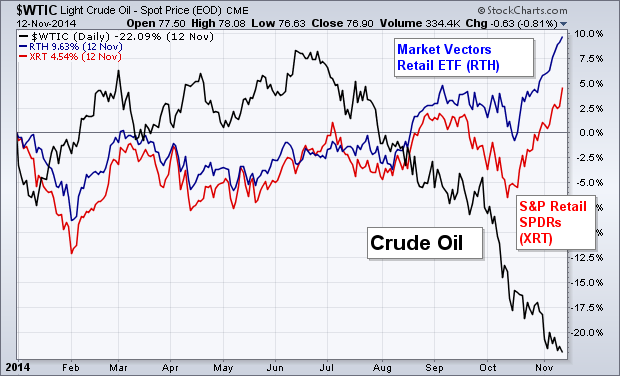

The black line in Chart 2 represents the price of Light Crude Oil since the start of the year. The two rising lines represent the two most popular retail ETFs. As a rule, falling oil prices are good for retail stocks because it gives customers more discretionary money to spend. That's been especially true since the middle of June when oil prices started to tumble. Although both retail ETFs have risen since July, the Market Vectors Retail ETF (RTH) has done better than the S&P Retail SPDRs (XRT). Since the start of the July, the RTH (blue line) has risen 13% versus a 5% gain for the XRT. That being the case, I'm going to focus in this message on the RTH. Wal Mart happens to be the largest holding in the RTH (10%).