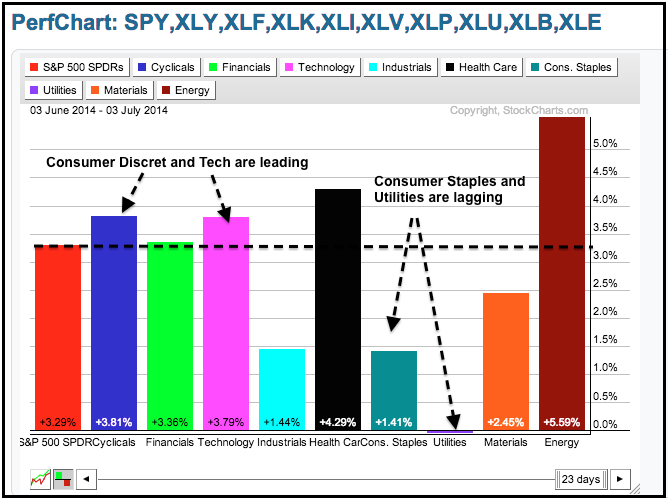

Relative weakness in the consumer discretionary sector was a concern a month ago, but not anymore. The first PerfChart shows the Consumer Discretionary SPDR (XLY), the Technology SPDR (XLK), the Energy SPDR (XLE) and the HealthCare SPDR (XLV) leading since June 3rd. XLY really came to life this past week with a new 52-week high and a gain that was greater than that of the S&P 500.

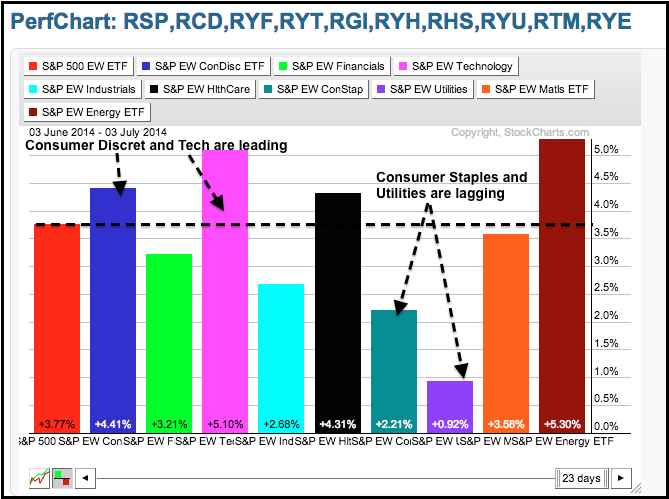

It is quite positive to see these two sectors leading the stock market. The consumer discretionary sector is the most economically sensitive sector and relative strength here is a positive sign for the economy. The technology sector is also an important barometer because it has the stocks with the highest betas (volatility). This means the tech sector represents the appetite for risk and a healthy appetite for risk bodes well for stocks. In contrast to these offensive sectors, notice that the Consumer Staples SPDR (XLP) and Utilities SPDR (XLU) were the weakest sectors. As defensive sector, this indicates that money is moving from defense to offense. The second PerfChart shows the equal-weight sectors with similar characteristics.

Good trading and good weekend!

Arthur Hill CMT