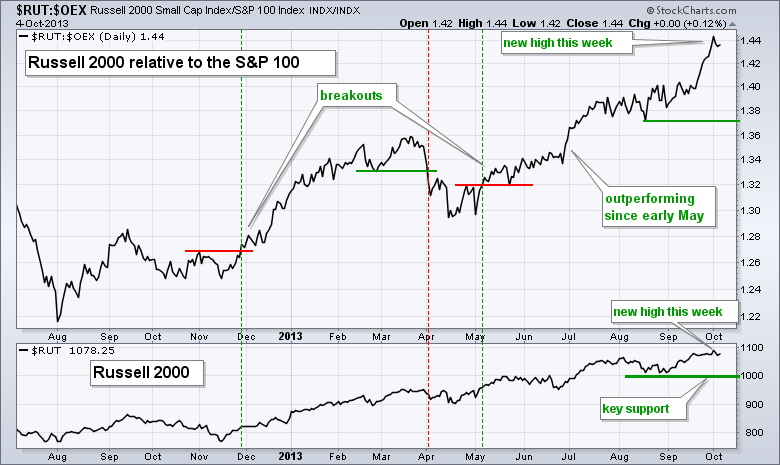

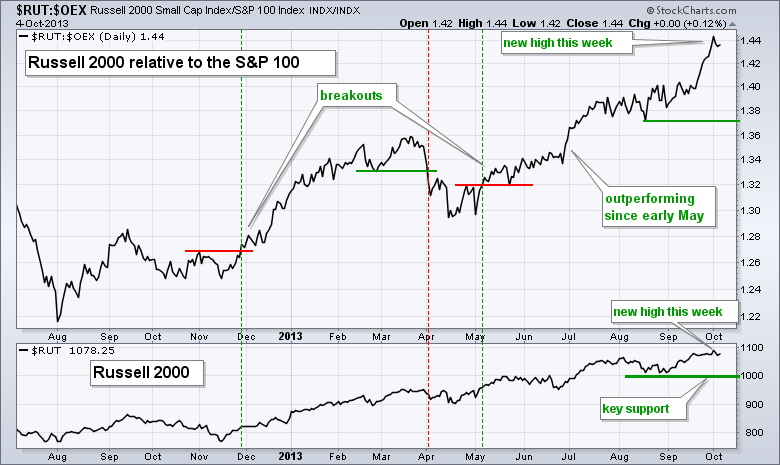

The Russell 2000 ($RUT) and the Nasdaq ($COMPQ) are leading the relative performance game and this is positive for the stock market. The Russell 2000 represents small-caps and the Nasdaq represents the technology sector. Together, these two represent risk appetite because their stocks have higher betas, which translates into higher volatility. The appetite for risk is strong when these two lead and weak when these two lag. Also note that small-caps are less diversified and more dependent on the domestic economy. This makes small-caps the proverbial canaries in the economic coalmine. Relative strength in small-caps is also a positive indication for the economy.

Click this image for a live chart

The first chart shows the Russell 2000 relative to the S&P 100 using the price relative ($RUT:$OEX ratio). This ratio broke out in May, trended higher for several months and hit a 52-week high this week. A new high in the price relative means small-caps are outperforming large-caps and this is bullish for the overall market. The indicator window shows the Russell 2000 ($RUT) hitting a new high earlier this week and affirming the long-term uptrend. The August lows mark key support around 1000. The second chart shows the Nasdaq relative to the NY Composite using the $COMPQ:$NYA ratio. This ratio also hit a new high this week as the Nasdaq continues to outperform the NY Composite.

Click this image for a live chart

Good trading and good weekend!

Arthur Hill CMT

Click this image for a live chart

The first chart shows the Russell 2000 relative to the S&P 100 using the price relative ($RUT:$OEX ratio). This ratio broke out in May, trended higher for several months and hit a 52-week high this week. A new high in the price relative means small-caps are outperforming large-caps and this is bullish for the overall market. The indicator window shows the Russell 2000 ($RUT) hitting a new high earlier this week and affirming the long-term uptrend. The August lows mark key support around 1000. The second chart shows the Nasdaq relative to the NY Composite using the $COMPQ:$NYA ratio. This ratio also hit a new high this week as the Nasdaq continues to outperform the NY Composite.

Click this image for a live chart

Good trading and good weekend!

Arthur Hill CMT

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More