Gold is medium-term oversold and ripe for a bounce, but the long-term trend remains down with a target in the $1000 area. There are two big moves defined by two sets of retracement lines on this chart. The first extends from the 2001 low to the 2011 high (±250 to ±1900). A normal 50-61.80% retracement of this advance would extend to the 900-1100 area. There is also potential support in the 1000 area from broken resistance and the February 2010 low (orange shading). Thus, 1000 is the long-term target for gold at this point.

Click this image for a live chart.

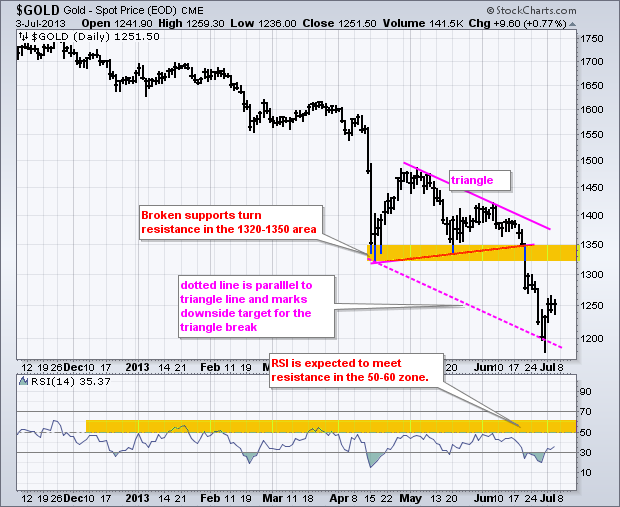

Medium-term, gold is oversold after a plunge from 1800 to 1200. Notice that 12-month RSI is near 30 for the first time since 1999. Oversold conditions typically occur in downtrends, not uptrends. Overbought conditions are typical for uptrends (green arrows). In addition to medium-term oversold conditions, gold is in a support zone marked by the 61.80% retracement and broken resistance from the December 2009 high. The combination of oversold conditions and support could give way to a bounce back towards the 1320-1350 area. The long-term downtrend, however, is expected to takeover at some point and the subsequent resumption would open the door to $1000, which might make Grover Cleveland happy.

Click this image for a live chart

Have a great weekend!

--Arthur Hill CMT