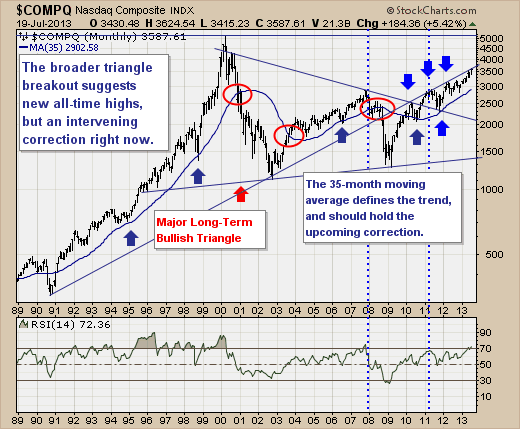

The NASDAQ Composite is a "forgotten index", as it led the tech bubble higher into the 2000 high. Now, it is the NASDAQ 100 that garners all the attention given it consists mainly of Apple (AAPL) and Google (GOOG). But that aside, the Composite is on a bullish run that looks to hit new highs in the years ahead as the long-term bullish triangle breakout remains in force. However, in the interim - a rather sharp and nasty correction is anticipated.

Technically speaking, prices have now rallied again into long-term trendline resistance connecting the 1990 and 1992 lows, and as in previous cases - a decline is expected to occur. Also, note that post-bubble price behavior has faltered from trendline resistance in tandem with the 14-month RSI hitting the overbought 70-level. Thus, the risk-reward is skewed towards the downside, with a test of the longer-term 35-month moving average expected.

Lastly, the depth of the correction can be up to -20% given current price levels and the rising 35-month moving average. But in reality, it will likely be something less than this, but otherwise a very good downside trade...which hasn't occurred in quite some time. Now, if the 35-month moving average is violated, then we would understand that a decline far greater than -20% were underway, and a clear bear market. We don't anticipate this at this time, for the evidence isn't there to support it, but it does have a place in the probability distribution curve.

Good luck and good trading,

Richard