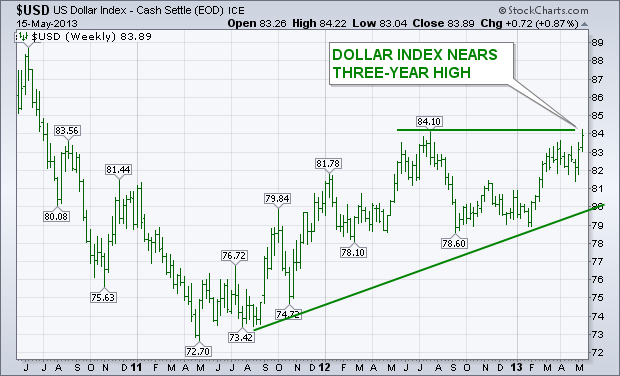

The chart below shows the U.S. Dollar Indexchallenging its mid-2012 high near 84. An upside breakout through that prior peak (which appears likely) would put the dollar at the highest level since mid-2010. The dollar has become the world's strongest currency. One of the reasons for the stronger greenback is the fact that the U.S. economy is now the strongest among developed markets. Another is chatter that the Fed is planning to cut back on bond purchases (quantitative easing) sooner rather than later. That's in contrast to other central bankers who are accelerating their easing process. Japan is the biggest example of that. But the weaker yen has forced the South Koreans to lower rates to weaken their currency (the won). [A plunging yen has pushed money into the higher yielding won which hurts South Korean exports that compete with Japan]. Europe has lowered rates to combat the longest recession in the postwar era. Australia has lowered rates to combat the deflationary impact of falling commodity prices and slowing Chinese demand. [80% of Australia's exports to China are natural resources]. The stronger greenback has a lot of intermarket implicatons for other markets, which include commodities and stocks.

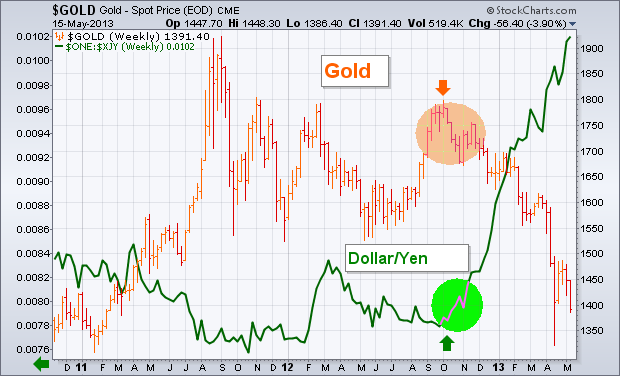

Subscribers may remember that my Market Message from last December (20) carried the headline: "A Peak in the Yen Appears to be Dragging the Price of Gold Lower". The weekly bars in the following chart show the price of gold peaking during the fourth quarter of last year and tumbling to the lowest level in two years during 2013. The green line shows the U.S. Dollar rising against the yen during that same time span. The upturn in the dollar/yen (green circle) during October coincided exactly with the peak in gold. Since the start of October, the dollar has risen 24% against the yen, while gold has lost -21%. By contrast, the Dollar Index has risen only 5% during those eight months, while the Euro has been flat. That appears to confirm my December view that the plunging yen has been the main driver of falling gold prices, and not the USD which is dominated by the Euro.

- John