While gold is still maintaining a long-term consolidation, gold mining stocks have signalled still lower prices to come.

A quick look at the weekly gold chart shows that the metal is holding above a line of support that goes back over a year.

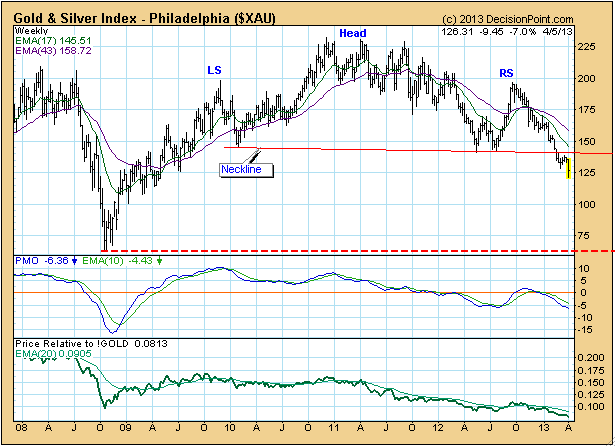

In contrast, the XAU (gold mining stocks) has formed a bearish head and shoulders pattern, which executed when price dropped below the neckline earlier this year. We can see that the breakdown was followed by a brief snapback before the decline continued. At this point the minimum downside target would be the support line drawn from the October 2008 low.

It would be useful to note how dissimilar the two price lines are. One would think that the stocks would be closely related to the metal, but the charts will quickly clear up that misconception. (Prices are intraday.)

Conclusion: While for the time being gold has bounced off long-term support, the XAU has signalled that there are still lower prices ahead for gold mining stocks.