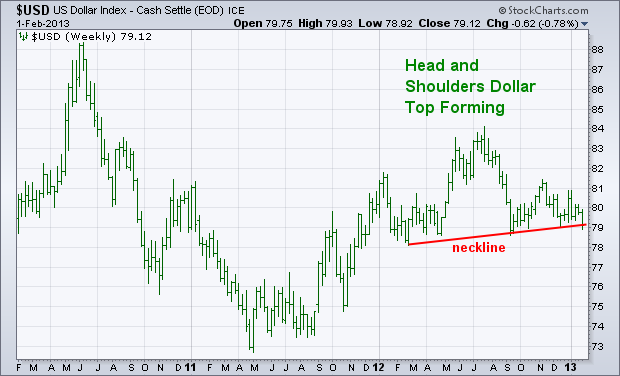

My Thursday message showed the Power Shares Dollar Index Bullish Fund (UUP) on the verge of a technical breakdown. The weekly bars in Chart 1 show the cash version of the Dollar Index. It too has a bearish look by showing the US Dollar Index threatening to fall below a "neckline" drawn under its 2012 lows. That would signal a drop in the $USD to it 2011 lows. [Thursday's message showed most of the dollar weakness coming from rising European currencies]. One asset class that would benefit from a falling dollar is commodities. That partially explains why commodities ended the week on a strong note. The weekly bars in Chart 2 show the DB Commodities Tracking Fund (DBC) climbing to a three-month high (brown circle). [The DBC includes 14 energy, metal, and agricultural commodities]. Chart 2 also shows the dollar (top of chart) and commodities trending in opposite directions over the last two years. A "neckline" is drawn on the commodity index over its 2012 highs (which matches the bearish "neckline" on the USD). Commodities are also starting to play catchup to a rising stock market and stronger economic signals. In that scenario, economically-sensitive commodities like energy and industrial metals should be the biggest gainers. Agriculturals and gold are commodity laggards.