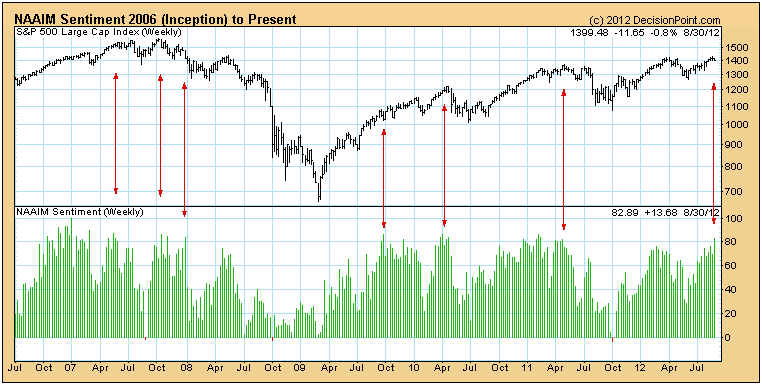

The National Association of Active Investment Managers (NAAIM) weekly poll* shows that they are 83% long. This qualifies as an extreme level of optimism, and should cause concern.

On the following chart we can see that readings above 80% are not a magic number or an automatic sell signal; however, when sentiment reaches that level, we should begin looking for at least a brief correction. (Note that we have not identified every reading over 80% but have placed markers to provide points of reference.)

This spike of optimism comes as we are entering the September-October time period, the most seasonally negative two months of the year. We do not view this as a happy coincidence.

* NAAIM sentiment polling is conducted by The National Association of Active Investment Managers (www.naaim.org). Cutoff for the poll is Wednesday, and the results are released Thursday.

Approximately 40 NAAIM member firms who are active money managers are asked each week to provide a number which represents their overall equity exposure at the market close on Wednesday. Responses can vary widely as indicated below. Responses are tallied and averaged to provide the average long (or short) position or all NAAIM managers, as a group.

Range of Responses

200% Leveraged Short

100% Fully Short

0% to 100% Cash or Hedged to Market Neutral

100% Fully Invested

200% Leveraged Long