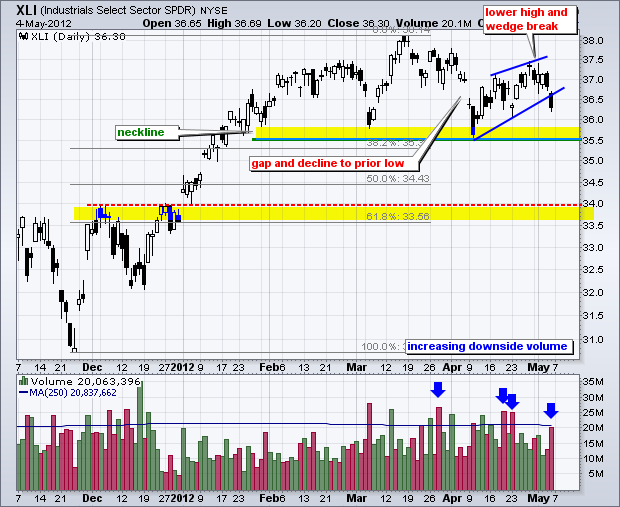

With a gap down and sharp decline, the Industrials SPDR (XLI) formed a lower high and broke wedge support. But that's not all. The chart below also shows a potential head-and-shoulders pattern taking shape. After hitting a 52-week high in March, the ETF declined all the way back to the early March low in the 35.50 area. This deep dip showed an increase in selling pressure. Also notice the large gap down in early April.

Click this image for a live chart.

XLI was oversold in early April and bounced back to the 37.5 area. This bounce formed a lower high, which shows diminishing buying pressure because the ETF fell short of the prior high. This week's wedge break reverses the April bounce and sets up a test of neckline support. A break below the March-April lows would complete the head-and-shoulders reversal and target a move to the next support zone around 34. Support here stems from the 50-62% retracement zone and broken resistance from the early December high.

The indicator window shows volume bars with downside volume (red) outpacing upside volume (green) since late March. This suggests that selling pressure is picking up steam and buying pressure is diminishing. Also notice that Friday's decline occurred on the highest volume in nine days.

Good trading,

Arthur Hill CMT