With all the press centering in upon Gold gains recently +10%, Silver has risen by +19% - thereby outperforming the yellow metal by +9%. Silver - the poor man's good; now looks rather ripe for trading once again. This is as it should be in a metals bull market - silver should always outperform gold. And the manner in which the technicals are shaping up in both absolute and relative terms - we should see both gold and silver move to new highs and not return to the lows forged on 12/30/11 at $1567 and $27.88 respectively.

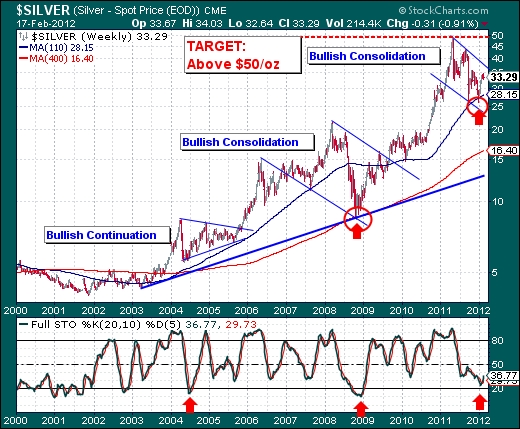

In our opinion, we shall be playing silver form the long side, for the techncials are rather compelling. First, the weekly Silver chart shows a series of continuation patterns or bullish consolidations that have all lead to new highs. And, each one began with the 20-week stock at oversold levels. In fact, the first two times this occurred, silver rallied for 2-years plus and gained in the multiple of 100%s. Next, let's note the current price has held the 110-week moving average. which it has done on a number of occasions, and then rallied rather strongly. We expect this current test amid the bullish consolidation to take silver price upwards of $50/oz or more - a minimum gain of +34%, which is really rather paltry by past rallies, but one that has the potential to go much much higher.

Therefore, we are left to wonder what shall trigger such buying in the metals and silver in particular. Will be be turmoil in the Middle East? The Euro falling apart? Faster-than-expected economic activity around the world? New rounds of QE? They are all good questions, and perhaps an amalgamation would probably be the most likely scenario.