Last week, the world's stock markets cheered the coordinated central bank efforts to supply dollar liquidity to the world banking system via lower than market rates. This clearly resulted in a "risk-on" trade across the board, and we expect more to follow in the weeks ahead as the ECB lower rates, and China moves quickly to halt its declining economy.

Our interest in this new round of money printing and stimulus stands in the precious metals again such as gold, silver and platinum. We can make a very bullish case for each at this point, but we'll focus on the "high-beta" silver futures contract. All healthy precious metal bull markets are led by silver; and we sense that silver is now poised to outperform once again - with new contract highs forging above the $50/oz level.

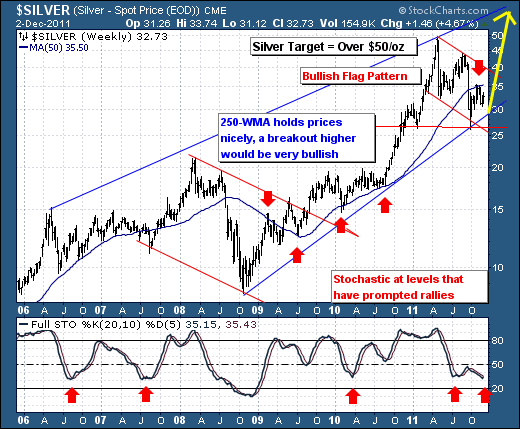

The techncials of the trade are rather simple: silver has traced out a rough 9-month bullish "flag pattern", which tends to resolve itself in the direction of the major trend, which is higher given the pattern of higher lows. Also, we point out that the 20-week stochastic is back to levels that in the past have coincided with rather major bottoms. The only caveat is the rolling over 250-week moving average, which on many occassions has shown its bullish and bearish worth. We are of the opinion, that once the 250-week is violated to the upside at $35.50 - this a rally of massive proportion shall be upon us. Lest we not add that that Wednesday's daily trade put in place a key reversal higher - which in our mind is sufficient to consider long positions at current levels.

Good luck and good trading,

Richard