Based on the writings of Charles Dow, Dow Theory utilizes the Dow Industrials and Dow Transports to generate buy and sell signals for the broader market. The market trend is up when both forge higher highs. The market trend is down when both forge lower lows. A non-confirmation is present when only one forges a higher high or lower low.

The first chart shows the Dow Industrials within a clear uptrend from late August to early May. This uptrend started to falter when the Average failed to exceed its prior high and formed a lower high in July. A clear trend reversal occurred this week as the Average broke below its June low.

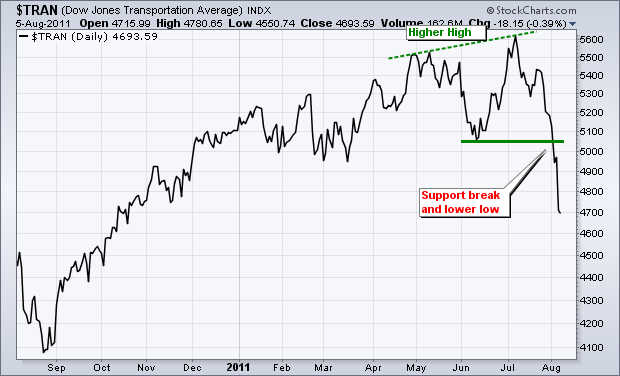

The other chart shows the Dow Transports with an uptrend from August until early July. Notice the difference? The Dow Transports exceeded its May high to forge a higher high in July. The Dow Industrials failed to confirm this new high in the Dow Transports. This non-confirmation was a warning sign, but not a sell signal. The Dow Theory sell signal did not materialize until both Averages broke below their June lows. How long will this sell signal remain in effect? Until there is a Dow Theory buy signal with higher highs in both Averages. There is no timeframe for these signals. They are simply in force until proven otherwise.