ChartWatchers July 16, 2011 at 03:55 PM

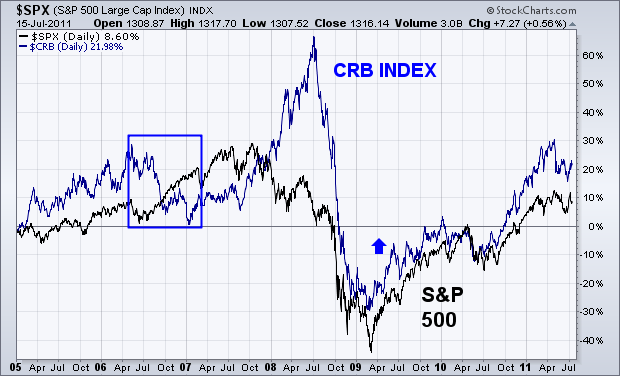

The positive link between stocks and commodities doesn't always exist as shown in Chart 1. There have been periods in the past when they've trended in opposite directions like the second half of 2006 (see box). Stocks also have a history of peaking before commodities... Read More

ChartWatchers July 16, 2011 at 03:48 PM

At times, it is best to step back and take a longer-term viewpoint of the markets; and today we'll examine the Russell 2000 Small Caps (RUT)... Read More

ChartWatchers July 16, 2011 at 03:36 PM

While this bull market has rallied +105% from the 2009 low (basis the S&P 500), I have had a sense that there was something "squishy" about it. One thing was the absence of convincing volume, something analysts have been complaining about since the bull market began... Read More

ChartWatchers July 16, 2011 at 02:00 PM

Hello Fellow ChartWatchers! Today I'm pleased to announce another major upgrade to StockCharts.com. We've just added end-of-day data for US futures contracts as well as end-of-day spot prices to our system. The data is available for free to everyone... Read More

ChartWatchers July 14, 2011 at 07:18 PM

Gerald Appel created the MACD in the late 1970s. It's a momentum oscillator that serves to gauge the strength and direction of a trend, but what I find most useful is its ability to predict a reversal. If you like to short weak stocks, I can't blame you... Read More

ChartWatchers July 03, 2011 at 01:05 PM

Many months ago, we began a series of articles that we called "TA 101." The articles covered the basics of stock charting. The most recent article in the series was published in January of 2010... Read More

ChartWatchers July 02, 2011 at 10:45 PM

QUESTION: Carl, is it okay to use the Trend Model on bond fund NAV's to manage risk, or is it inappropriate because you can't factor in monthly payouts? I own PTSAX, Bill Gross' total return investor class bond fund, and it looks like the 20-EMA is ready to cross down through the... Read More

ChartWatchers July 02, 2011 at 10:43 PM

It was a good week for commodities and an even better week for stocks. But it all started with the dollar. We explained earlier in the week that the Dollar Index (UUP) appeared to be in a bearish consolidation pattern within a major downtrend... Read More

ChartWatchers July 02, 2011 at 10:37 PM

I was certainly looking for a bounce last week, but if I'm being honest, I wasn't looking for THAT kind of bounce. Our major indices all gained over 5% in just one week. That's not a bad return for a YEAR!!! There were definitely signs of a bounce on the horizon... Read More