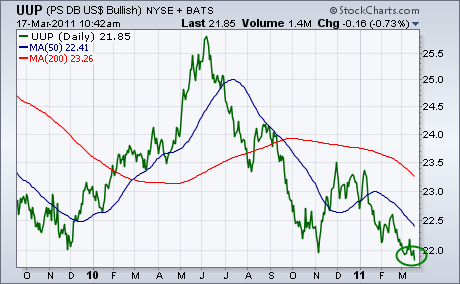

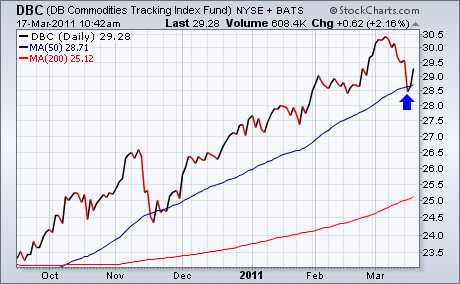

Traders continue to sell the U.S. Dollar. In yesterday's trading, the dollar fell to a 20-year low against the Japanese yen. Today, it's falling against everything else. More importantly, the greenback is breaking important support levels. Chart 1 shows the PS Bullish Dollar Index (UUP) falling to the lowest level in three years. One of the side-effects of a falling dollar is stronger commodities and shares tied to them. Right on cue, both are bouncing. Chart 2 shows the DB Commodities Tracking Index Fund (DBC) bouncing off its 50-day moving average (blue line) and gaining 2%. Virtually all individual commodities are bouncing today. As are shares related to them. Chart 3 shows the Energy Sector SPDR (XLE) bouncing off its 50-day line. Precious metal shares are also rebounding.