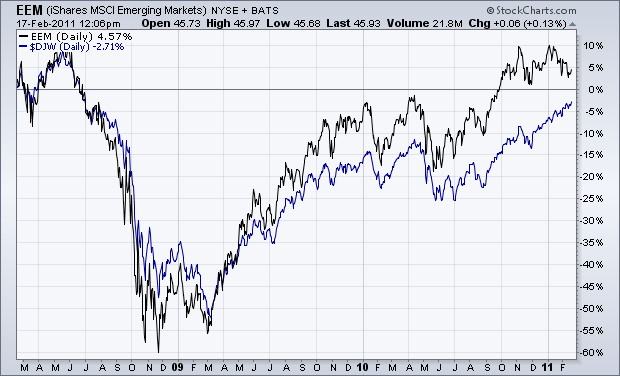

I'm not a believer in global decoupling. On the contrary, I believe that global stock markets are highly correlated and usually trend in the same direction. That's especially true of the relationship between emerging and developed markets. Chart 1 shows a strong correlation between emerging markets (black line) and the Dow Jones World Index of developed markets (blue line). The main point is that these global markets usually rise and fall together. The chart also shows that emerging markets have risen a lot faster than developed markets since the 2009 bottom. In fact, emerging markets gained 130% from that bottom versus 90% for developed markets. Growth in the larger emerging markets like China and India is often cited as the engine driving global economic growth and uptrends in stocks and commodities. Problem is stock markets in those countries have been falling since last November.