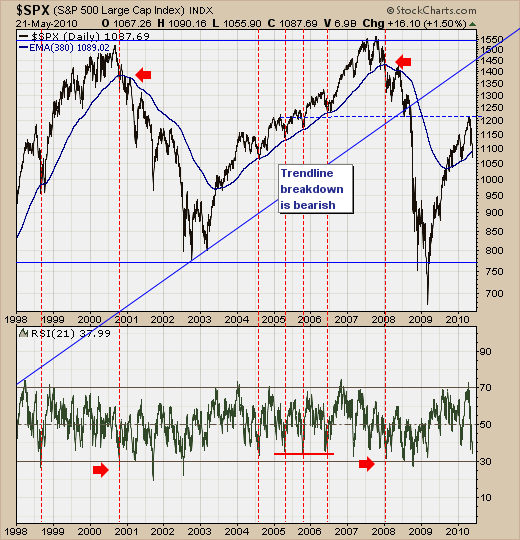

The S&P 500 decline over the past several weeks has reached a critical junction point in the decline at the 380-day exponential moving average support level. There are several forward scenarios that can occur:

1) Prices are sufficiently oversold on a short-term basis to where the S&P can manage to move to new highs above the 1217 level. This would represent a rally of +12% or thereabouts. The question would then become whether significant and material negative divergences developed in the advance/decline and new highs/new lows indicators that would suggest a major top in the making. This period would likely be akin to that of the August to October 2007 rally that led to the end of the cyclical bull market.

2) Prices are sufficiently oversold on a short-term basis to where the S&P can only manage a countertrend rally towards the 1130-to-1180 zone, and then fall back and breakdown below the 380-day exponential moving average in an end to the cyclical bull market from the March-2009 low. This countertrend rally would be had with very poor underlying advance/decline figures and slack volume patterns.

3) Lastly, the current decline that has nascently broken through the 380-day exponential moving average - continues its extension lower without an relief or respite rally whatsoever. This would along the lines of a "mini-crash" or perhaps something even more dour. This would be the "tail risk" event that very few are expecting.

Having said this, the odds obviously favor one of the first two scenarios, with the first scenario in all probability being the "most likely" at this juncture. We have a difficult time postulating this course, but the technical evidence at the recent highs were coexistent with simply an interim high rather than a high formed by major negative divergences or non-confirmations. Lowry's rightly notes that all major bull market highs have had certain conditions attached to them; of which they were not present at the recent S&P high at 1217. They say we live in historically interesting times; and this case is no different. But is this time really different to warrant a different outcome than the probabilities suggest?

Good luck and good trading,

Richard