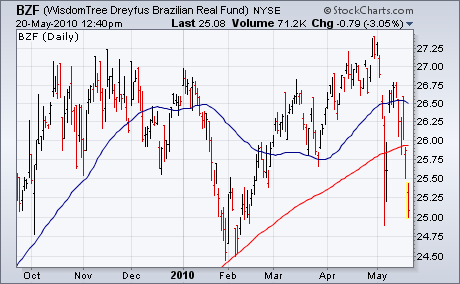

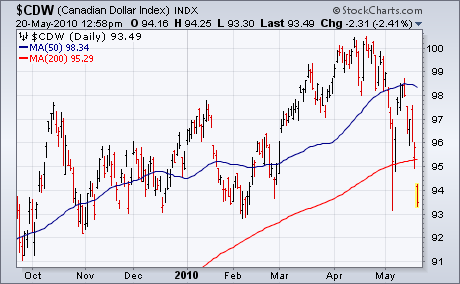

In early April, I expressed the view that the rally in the U.S. Dollar Index was coming mainly from weaker European currencies which meant that the dollar rally wasn't as widespread as it appeared. To support that view, I showed three foreign currencies that were rallying strongly against the greenback that included the Australian and Canadian Dollars along with the Brazilian Real. It didn't hurt that those three currencies were tied to commodity-producing countries and showed that global traders were still willing to assume some risk. That situation has changed. The next three charts show all three currencies plunging below their 200-day moving averages. The hardest hit by far is the Aussie Dollar. Chart 3 shows that high-yielding currency plunging to the lowest level in nine months. Money leaving high-yielding currencies usually flows into lower-yielding ones like the Japanese yen in a flight to safety.