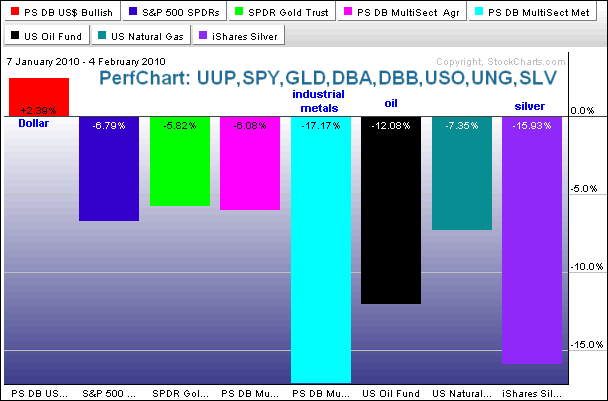

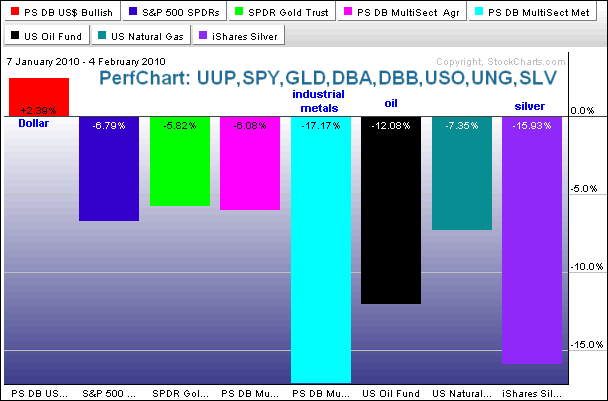

In addition to stock markets around the world, we have seen a rout in various commodity groups over the last 3-4 weeks. Strength in the Dollar is partly to blame. Weakness in global equities also bodes ill for the commodities. A downturn in global equities would imply a future downturn in the global economy that would dampen demand for commodities. In Thursday's Market Message, John Murphy showed the DB Commodity Index Tracking ETF (DBC) breaking below its 200-day moving average. The PerfChart below shows six commodity related ETFs with the S&P 500 ETF (SPY) and the DB Dollar Bullish ETF (UUP). Of these eight securities, only the DB Dollar Bullish ETF (UUP) is up over the last four weeks. The DB Base Metals ETF (DBB) and the Silver ETF (SLV) are pacing the declines with losses in excess of 15%. Silver is an industrial metal so the relationship here makes sense. The US Oil Fund ETF (USO) is also down double digits.

Click this image to see a live chart.

Click this image to see a live chart.

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More