According to the

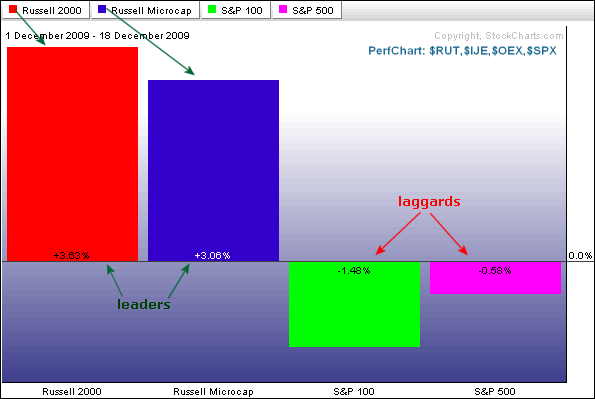

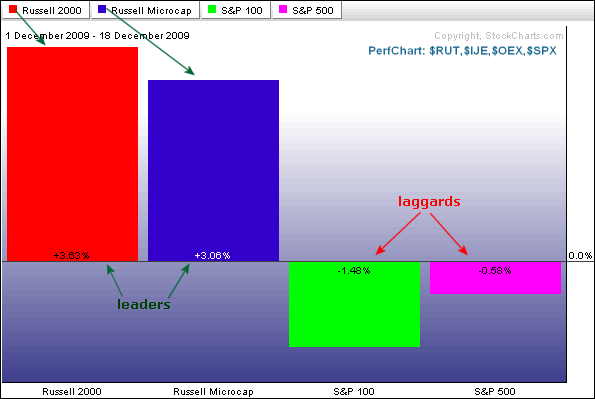

Stock Trader's Almanac, the January effect is the historical tendency of small-caps to outperform large-caps from mid December until April. Notice that this period coincides with the bullish six month cycle that extends from November to April. Historically, the strongest period of small-cap outperformance runs from mid December until end January. Judging from small-cap performance in the first half of December 2009, it appears that the January effect is starting early this year. The Perfchart below shows two small-cap indices, the Russell 2000 ($RUT) and Russell Microcap Index ($IJE), and two large-cap indices, the S&P 500 and the S&P 100 ($OEX). From December 1st to December 18th, the two small-cap indices are up, but the two large-cap indices are down. This is some pretty strong outperformance from small-caps.

Click image to see a live PerfChart

Click image to see a live PerfChart

Click image to see a live PerfChart

Click image to see a live PerfChart

About the author:

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic approach of identifying trend, finding signals within the trend, and setting key price levels has made him an esteemed market technician. Arthur has written articles for numerous financial publications including Barrons and Stocks & Commodities Magazine. In addition to his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Business School at City University in London.

Learn More