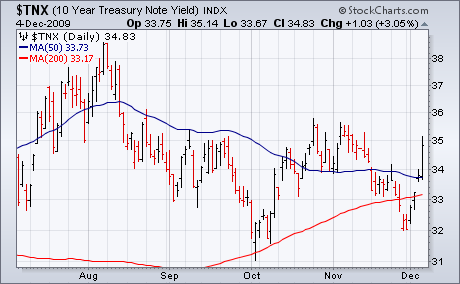

Sometimes good news produces a bad effect. That's especially true when dealing with financial markets. Today's unemployment report dropped to 10% and payrolls fell by an unusually small amount. That good news was given a positive reception by most markets. By day's end, however, commodities and stocks were on the defensive. The good news caused a big jump in the 10-Year T-note Yield (Chart 1) as bond prices fell sharply. The jump in bond yields (and a more positive view on the U.S. economy) pushed the dollar higher. Chart 2 shows the Power Shares Dollar Bullish ETF (UUP) surging 1.5% on the heaviest volume in two months. The UUP is now challenging its 50-day moving average. Chart 3 shows the Euro (which trends in the opposite direction of the UUP) falling below its 50-day moving average for the first time in several months. The rising dollar caused profit-taking in commodities, and gold in particular.