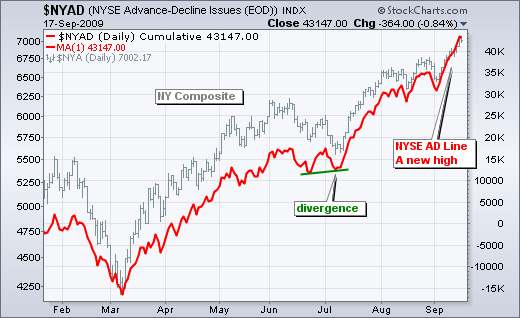

With a surge over the last two weeks, the AD Line and AD Volume Line for the NYSE hit new reaction highs. The first chart shows the NYSE AD Line moving above its August highs with a sharp advance this month. The AD Line is a cumulative measure of Net Advances (advances less declines). This indicator rises when there are more advancing stocks and falls when there are more declining stocks. It is one of the simplest, and purest, breadth indicators. With a new high this month, there is no sign of weakness right now. If anything, the AD Line looks overextended and ripe for a rest.

The second chart shows the NYSE AD Volume Line, which is a cumulative measure of Net Advancing Volume (volume of advancing stocks less volume of declining stocks). While the AD Line and Net Advances reflect small and mid-cap performance, the AD Volume Line and Net Advancing Volume reflect large-cap performance. For the AD Line, an advance counts as +1 and a decline counts a -1, regardless of market capitalization or volume. This puts small-caps on equal footing with large-caps. Volume is a different story because large-caps dominate the most active list. With the AD Volume Line also moving to a new high for the move, breadth for large-caps is also strong and shows no signs of weakness right now. Click this chart for details.

Click this chart for details.