The FOMC has now become very serious to put an end to the financial crisis. To put it simply, Wednesday's FOMC announcement that they plan to roll the printing presses in order to buy $200 billion in longer-dated treasury paper is certainly a "positive." This will no doubt create more inflationary tendencies than we care to talk about, for the FOMC will be forced to buy far more in treasury paper than

anyone believe, so let's just call this the FOMC's "initial position." The fact of the matter is that it will be positive towards the commodity markets; and this is where we should focus our energies.

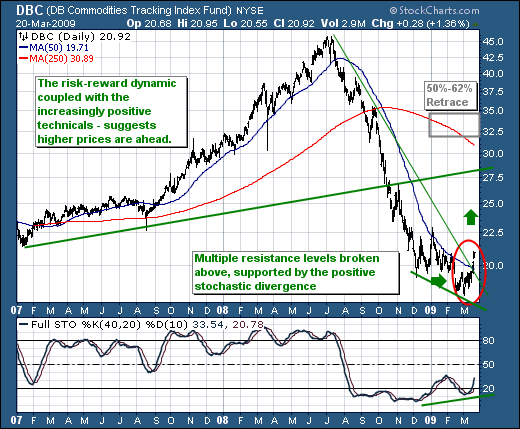

If one wants to get exposure to commodities other than through a futures contract, one can use the DB Commodities Index ETF (DBC), which includes the energies; the grains and other stuff the index is

made out. Moreover, we find that given this fundamental positive for the commodity markets, we also find that the technicals are syncing up with them as well - meaning the risk-reward dynamic favors being long

DBC now and on pull backs for the foreseeable future.

In particular, we are interested in fact prices moved to new lows and then rallied sufficient to breakout above trendline and 50-day moving avearge resistance levels, and did so not less on a "breakaway gap

higher." In our opinion, this is a powerful combination that should lead to mean reversion to overhead trendline resistance at $27.50, or even perhaps the 250-day moving average currently crossing at $31.00.

Given that DBC is currently trade at $21, we would only risk $2 to $19; thus the risk-reward is clearly skewed towards "reward" at this juncture.

Good luck and good trading,

Richard