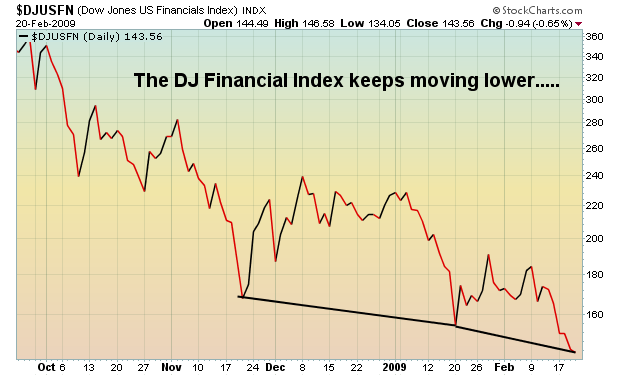

I receive a lot of questions regarding the "ultra" shares and "ultrashort" shares and how to effectively trade them. In particular, there are always questions asking why those "juiced" ETF returns don't correspond to the indices they're supposed to track over time. Let me give you an example. Take a look at the two charts below. The first is a five month chart of the Dow Jones U.S. Financial Index ($DJUSFN), while the second reflects the ProShares UltraShort Financial (SKF) during that same timeframe. The SKF is designed to inversely track the $DJUSFN at a 200% clip. In order to benefit from weakness in financials, you could purchase the SKF and profit to the tune of 200% the decline in the index. Just keep in mind that a ride on Space Mountain at DisneyWorld will seem like a stroll in the park compared to an investment in the SKF, however. :-)

On the line charts (line charts show only closing prices) below, take a look at where the SKF closed on February 20th vs. January 20th vs. November 20th. It was lower each time. But how can that be if the $DJUSFN is lower each time? If the index is putting in lower lows, shouldn't the ultrashort SKF be putting in higher highs? The answer is no - check this out:

Here's the bottom line. Avoid the temptation to trade the juiced ETFs based on its technicals. I've come to realize that the technicals associated with those ETFs are irrelevant. Instead, determine your entry and exit points based solely on the technicals of the underlying index that the ETF is designed to track. From that index, determine your target and apply those measurements to the juiced ETF.

Happy trading!