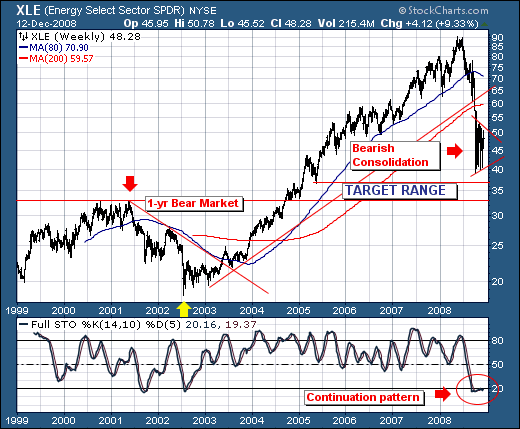

As we approach the end of the year, we find world stock markets attempting to trade a bit higher, although volatility remains quite high, but off it's worst high levels. However, we believe it shall not be low for very long; hence our propensity is to use this rally attempt to put put back on several short positions. From our trading perspective, we believe the energy sector have quite a bit of downside remaining...even thought the sector has been decimated. Our reasoning: lower crude oil prices on the order of $30-$36/barrel. This range is a bit wider than we have previously stated, and it incorporates last week's Goldman Sachs reversal from $200/barrel to $30/barrel in the next 3-months due to the widening of the "super contango." Our reading of the technicals behind the S&P Energy ETF (XLE) seem to bear this out...no pun intended!

Looking at the XLE weekly chart, we find prices fell off a cliff much like all other sectors - breaking down through its bull market trendline and its 70-week and 200-week moving averages. Obviously this is bearish stuff, with the trend remaining lower. What our interest is in at present is the manner in which prices are consolidating in sideways fashion in conjunction with the inability of the 14-week stochastic to move higher out of oversold territory. This argues rather strongly we think for a resumption of the downtrend in the very near future that should coincide with crude oil prices falling towards our above-stated range. Our target is $33-to$36, which is about -25% off current levels. The question is one of timing.