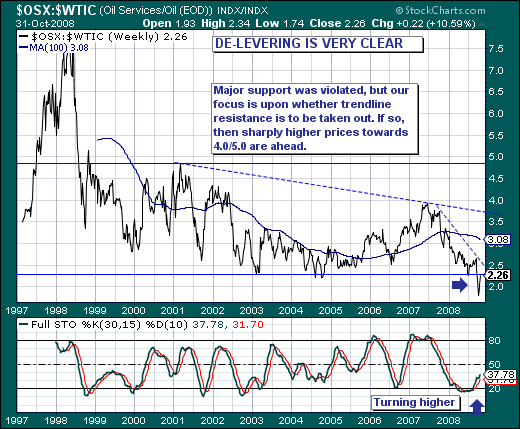

The world stock markets remain rather "volatile" as the credit crisis continues to unfold, while this volatility pendulum continues to create some very unique and interesting value propositions we haven't seen in quite some time. Our focus at present is the relative relationship of the Oil Service Index (OSX) to Crude Oil futures; and the fact that this relative ratio is just off its lowest point in over a decade - having fallen from its high above 8.0 in 1998 to its 2008 low near 1.70. The current course of de-levering by the world's hedge funds has pushed this ratio from 4.0 to its recent low near 1.70, with last week's surge higher putting overhead trendline resistance into view in terms of a bullish breakout.

We find this bullish setup interesting from the perspective that perhaps oil service shares may have forged their bottom given last week's reversal from major weekly/monthly support levels; however, we do expect oil service shares to at least retest their recent lows as our forecast for crude oil futures stands at $39-$40...down another $25-$30 from current levels. We would be remiss if we didn't believe that oil service shares would falter in tandem with the price of crude oil.

Having said this, our favorite choices on a retest are Transocean Offshore (RIG), Schlumberger (SLB), Weatherford Int'l (WFT) and National Oilwell Varco (HOV).