ChartWatchers July 19, 2008 at 10:05 PM

Tuesday afternoon marked a short-term bottom. In my opinion, we're going to print AT LEAST one more low in time; however, the sentiment had deteriorated on Tuesday to a point where we normally we see a rebound... Read More

ChartWatchers July 19, 2008 at 10:04 PM

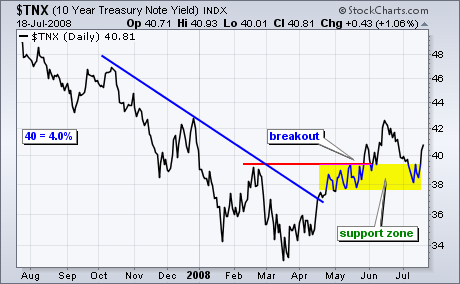

After the Producer Price Index (PPI) surged on Tuesday, it was little surprise to see big gains in the Consumer Price Index (CPI) on Wednesday. Bernanke warned of inflation in his congressional testimony last week and the PPI-CPI figures confirm... Read More

ChartWatchers July 19, 2008 at 10:03 PM

In my July 3 article I warned that the market was oversold, dangerous, and vulnerable to a crash. On Tuesday of this week, the S&P 500 opened down, breaking significant support, and kept moving lower. I thought to myself, "This is it. Crash in progress... Read More

ChartWatchers July 19, 2008 at 10:02 PM

Last week may very well have been an important turning point in the US stock market, with the Dow Industrials and the Russell 2000 Small Caps as forming bullish "key reversal" patterns to the upside... Read More

ChartWatchers July 19, 2008 at 10:01 PM

This week's downturn in crude oil prices has had a depressing effect on the entire commodity group. Chart 1 shows the CRB Index (plotted through Thursday) breaking a three-month up trendline (and its 50-day moving average)... Read More

ChartWatchers July 19, 2008 at 10:00 PM

Hello Fellow ChartWatchers! This week I wanted to tell you about a new feature we've just rolled out in our ChartNotes chart annotation tool. It is called "pinning" and it allows you to prevent any of your saved annotations from scrolling to the left over time... Read More

ChartWatchers July 06, 2008 at 10:06 PM

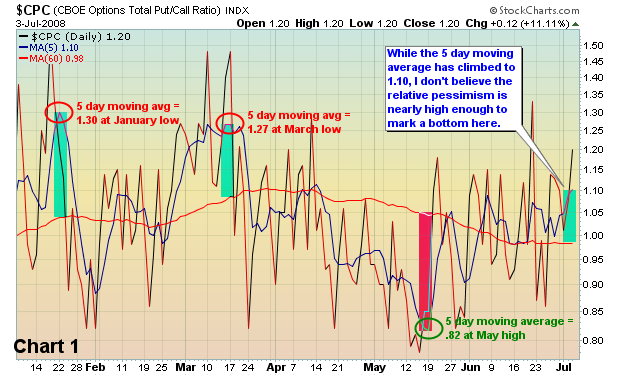

I'm the conservative type. I'm also nervous. I never like to see the market fall precipitously while market participants yawn. In a nutshell, that's what we've been seeing... Read More

ChartWatchers July 06, 2008 at 10:05 PM

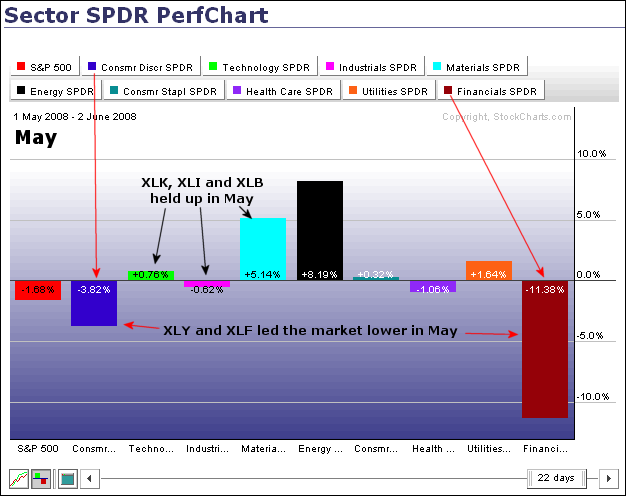

Sector performance in May and June shows the bear extending its grip into other key sectors. The Financials SPDR (XLF) and the Consumer Discretionary SPDR (XLY) woke up the bear with dismal performances in May... Read More

ChartWatchers July 06, 2008 at 10:04 PM

A bullish take on the stock market would be that (1) market indicators are very oversold, (2) there is a triple bottom setup on the S&P 100 Index, and (3) sentiment polls show a lot of bearishness... Read More

ChartWatchers July 06, 2008 at 10:02 PM

"UNIVERSAL LOGIN" NOW WORKING - We've finally, finally, finally fixed something that has been bugging lots of people for a long time. In the past, we had two very different ways to log into our website... Read More

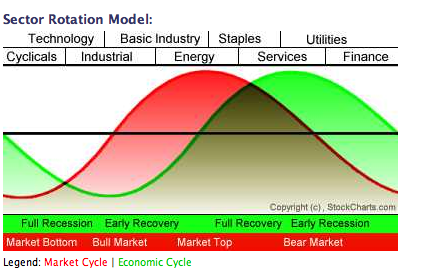

ChartWatchers July 06, 2008 at 10:01 PM

SECTOR ROTATION MODEL... One of our readers asked where we are in the Sector Rotation Model. That model shows the normal sector rotation that takes place at various stages in the business cycle. The chart shows that basic materials and energy are market leaders at a market peak... Read More

ChartWatchers July 06, 2008 at 10:00 PM

Hello Fellow ChartWatchers! This week's edition of ChartWatchers is full of important information including a lively debate about the health of the market - Tom Bowley is actually optimistic (well... somewhat), Arthur Hill not so much... Read More