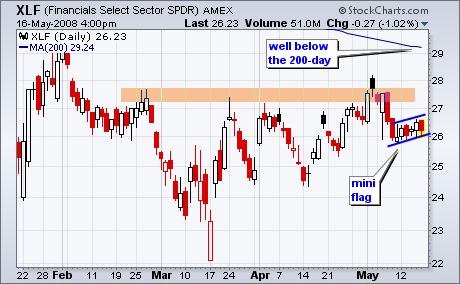

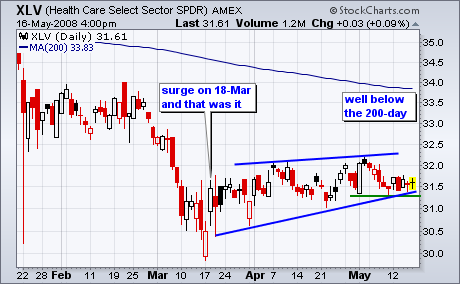

Money may be moving into Technology, but it is avoiding Finance and Healthcare. While the Dow Industrials ETF and S&P 500 ETF both touched their 200-day moving averages in May, the Finance SPDR (XLF) and the Healthcare SPDR (XLV) fell well short of their 200-day lines. The inability to keep pace with the broader market shows relative weakness.

On the price chart, the Finance SPDR (XLF) broke down last week and then stalled this week. With a slight rise over the last 6 days, a mini-flag formed with support at 26. Support here is also reinforced with the 50-day moving average. A break below 26 would end this rise and call for a continuation of the early May decline.

The Healthcare SPDR (XLV) is in even worse shape than XLF. After a bounce on 18-March with the rest of the market, XLV traded flat the last two months and went nowhere. In the process, a rising wedge formed with support just above 31. A move below the May lows would break wedge support and signal a continuation lower.