We recently noted the US had in our opinion entered into a bear market; hence we believe rallies are to be sold in the coming weeks/months as prices enter into resistance. However, we continue to hear how other world markets such as the European, Asian and Emerging markets will be 'immune' from the US-led slowdown, and thus funds should flow from the US towards more international markets. We think this to be patently wrong, for the time to be long international markets at the expense of US markets has past. With the US Federal Reserve addressing the problem - however futile this may prove or not prove - the international central banks are not addressing the looming crisis. Hence, we will posit that the US is poised to outperform the international markets for months if not years into the future given the 'lead' the Federal Reserve has created via lower interest rates.

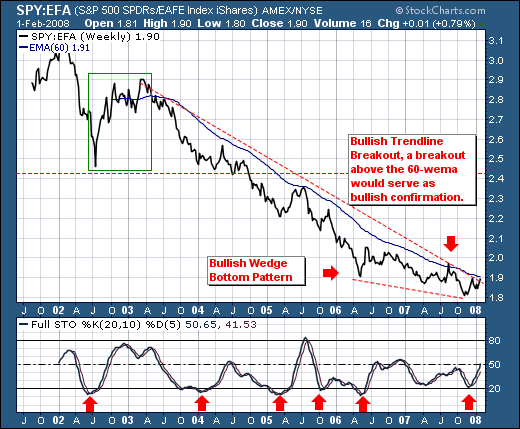

Technically speaking, we look at the ratio of the surrogate ETFs for the US and international markets - the S&P 500 Spyders (SPY) and the World ex-US (EFA). It is quite clear the trend has been lower since the world pulled out of recession in 2003, and the clear trade has been to be long International versus a short US position. But the emerging bullish wedge pattern suggests a trend change is in progress. A breakout above the 60-week exponential moving average would solidify this in our minds, and cause to err upon the side of being long US large caps at the expense of International markets.

This isn't the common prevailing wisdom; but given the contrarian nature of the trade... it shall catch everyone wholly off-guard and scrambling to make amends. So, for those overweight International Funds... this should serve as fair warning.