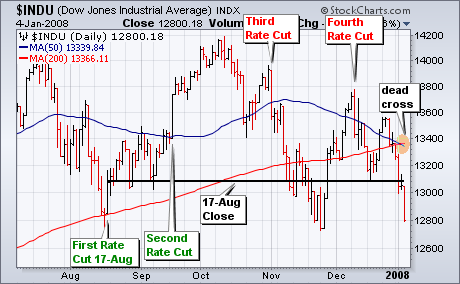

The Fed started cutting interest rates on August 17th with a surprise 50 basis points cut in the Discount Rate. There have been three more rate cuts since 17-Aug, but the Dow Jones Industrial Average has nothing to show for these cuts. The first two rate cuts fueled the rally from mid August to mid October. However, the last two rate cuts coincided with reaction highs on 2-Nov and 11-Dec (third and fourth cuts). The negative reaction to the last two rate cuts indicates that something is rotten in the kingdom of stocks. With Friday's employment report, the Dow moved below 13000 and finished the week below the 17-Aug close. The Dow is now down after four rate cuts. The bearish argument was further reinforced this week when the 50-day moving average moved below the 200-day for the first time since November 2005. This is also know as a "dead cross".