Last week, both the Dow Industrials and the S&P 500 broke out to new highs last week in show of modest strength; but what we find more interesting that this circumstance... is that the foreign markets aren't outperforming the US large caps. One only need understand that TV commentators; Wall Street strategists and the trading public is enamored with foreign market exposure , whether it be developed markets - or even emerging markets. A majority of incremental funds allocated to US mutual funds have gone towards international funds. This love affair with all things "international" is quite likely coming to a close.

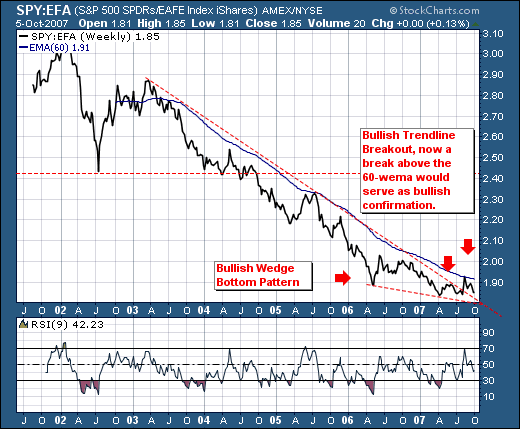

We'll simply show the ratio of the S&P 500 large caps (SPY) versus the Morgan Stanley EAFE Index (EFA), which tracks only international stocks. While money has poured into this sector, we find that since April 2006 - the out-performance has been minimal - especially given all the "hoopla." Too, we find the ratio has formed a bullish wedge bottom, with prices trading right below their 60-week exponential moving average. If prices breakout above this level - then this event would serve as confirmation to us that a multi-year period of international underperformance is ahead.

When you hear TV commentators or Wall Street strategists opine that the US is decoupling from international stocks; don't think again - they're right - but they are wrong given the US is very likely to outperform international stocks. This clearly will catch everyone offsides; which typically happens at major trading inflection points. Attention is to be paid.