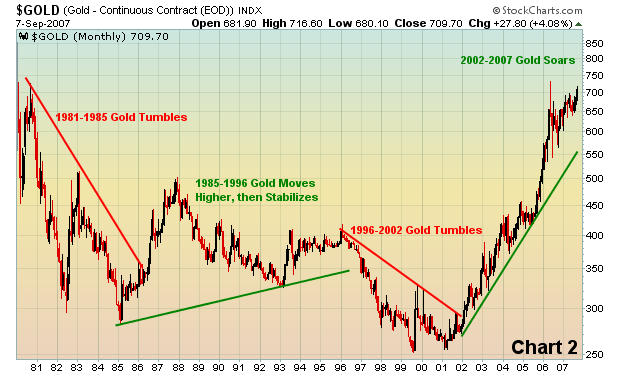

The jobs report sent a jolt to the stock market on Friday. We believe it'll be a temporary jolt, but a jolt nonetheless. That data gave the Fed all the ammunition it needs to do what the market has been expecting for weeks - to cut the fed funds rate. The question has now become, will it be 25 or 50 basis points? For the U.S. Dollar Index, it won't matter. The lowering of interest rates here in the U.S. will turn a weak dollar into an even weaker one. Take a look at the monthly chart (Chart 1) of the U.S. Dollar Index over the past 27 years and compare the movement in the dollar to the movement in gold prices (Chart 2) over that same span.

Clearly, there is an inverse relationship between the dollar and gold that has weathered many economic cycles. So here's the question we need to answer. If the Fed is on the verge of beginning an interest rate reduction campaign, will the dollar continue to weaken? We believe it will, which in turn should lead to a continuing bull market in gold, at least in the short-term say over the next 3-6 months. Then we'll re-evaluate.

We have maintained a very bullish theme on equities in general and once we clear the historically bearish month of September, we expect the bullish long-term trend to resume. In an environment of a weak dollar, we especially like the large cap multi-national stocks found on the NASDAQ 100 where earnings can be expected to rise significantly. We continue to favor the technology sector.