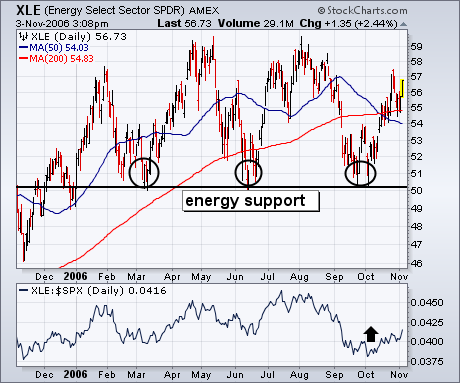

The last time I showed the Energy Sector SPDR (XLE) it was starting to bounce off chart support along its 2006 lows (see circles). Chart 1 shows that the XLE has climbed back over its moving average lines and may be heading toward the top of its 2006 trading range. Its relative strength ratio is starting to bounce as well. Oil Service stocks have been the weakest part of the energy patch. Chart 2 shows the Oil Service Holders (OIH) having broken their June/October downtrend line. I've suggested before that buying in energy stocks usually leads to buying in the commodities themselves. Rising bond yields on Friday gave a boost to the dollar. In an impressive show of strength, gold continued its recent climb.