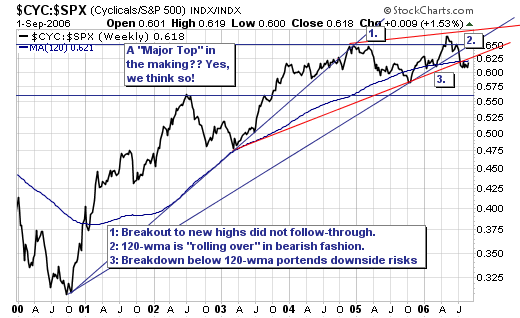

While many believe a "goldlilocks" soft-landing is forthcoming for the US economy; we think the probability of this occurring is rather small given the ongoing weakness in the housing market. That said, we are bearish on equities given our overbought indicators, and the fact this rally is becoming narrower with fewer and fewer stocks leading the major indices back towards the highs. Therefore, we would use rallies to layer into short positions. In terms of sectors, we believe the "cyclicals" are poised to decline on both an absolute as well as relative basis. Looking at the feature relative chart of the MS Cyclical Index vs. the S&P 500, we find a material "topping pattern" has formed, and indeed it is breaking down. Obviously, this suggests further weakness going foward; some of the major components of the MS Cyclical Index (CYC) are Phelps Dodge (PD), US Steel (X) and Caterpillar (CAT).